Why behind AI: Harvey

Let's check on the application layer

2025 was a big year for AI and cloud infrastructure software. Growth was outstanding in most areas, as many companies were able to capture demand for technical tools that help secure, build, and keep running the new applications.

Still, one of the interesting categories that we rarely cover here is the “AI natives”, companies that are building a vertical product for a specific niche. In my deep dive on Anthropic I shared this insider view of how they looked at the different accounts:

(On team composition): You can imagine on day one, we weren't verticalized. All four of us. (laughs). We just answered the phone whenever we could. Now we are. So now we have in the United States, we have a startups team, working with mostly native AI startups, hopefully building on our infrastructure that they're bringing to market. We have a digital natives team. It's kind of, it's like a little boring, but you're seeing in the weeds how we think about our go to market in a lot of ways. Digital native companies are basically startups from 10, 15 years ago that got really big. Stripe is a great example of one. They have a massive footprint of mostly software that they've built, and now they're trying to make that software AI native. And then we have more traditional enterprises, and in there, we've verticalized. Again, financial services, healthcare, life sciences. We have a list of others that aren't quite teams yet, but we're starting to specialize and understand what the most common use cases are.

The Anthropic team of course has been launching some supporting products for their industry play, including financial services, healthcare, and now a general productivity assistant called Cowork.

Today, we will not discuss Anthropic, though. We will focus on Harvey and their recently published “Year in Review”. It’s an interesting document—part marketing, part vision statement, part technical overview. I think that it serves as a good introduction to what a high-growth vertical AI company can look like, one that is providing a fairly complex product but abstracted for its audience.

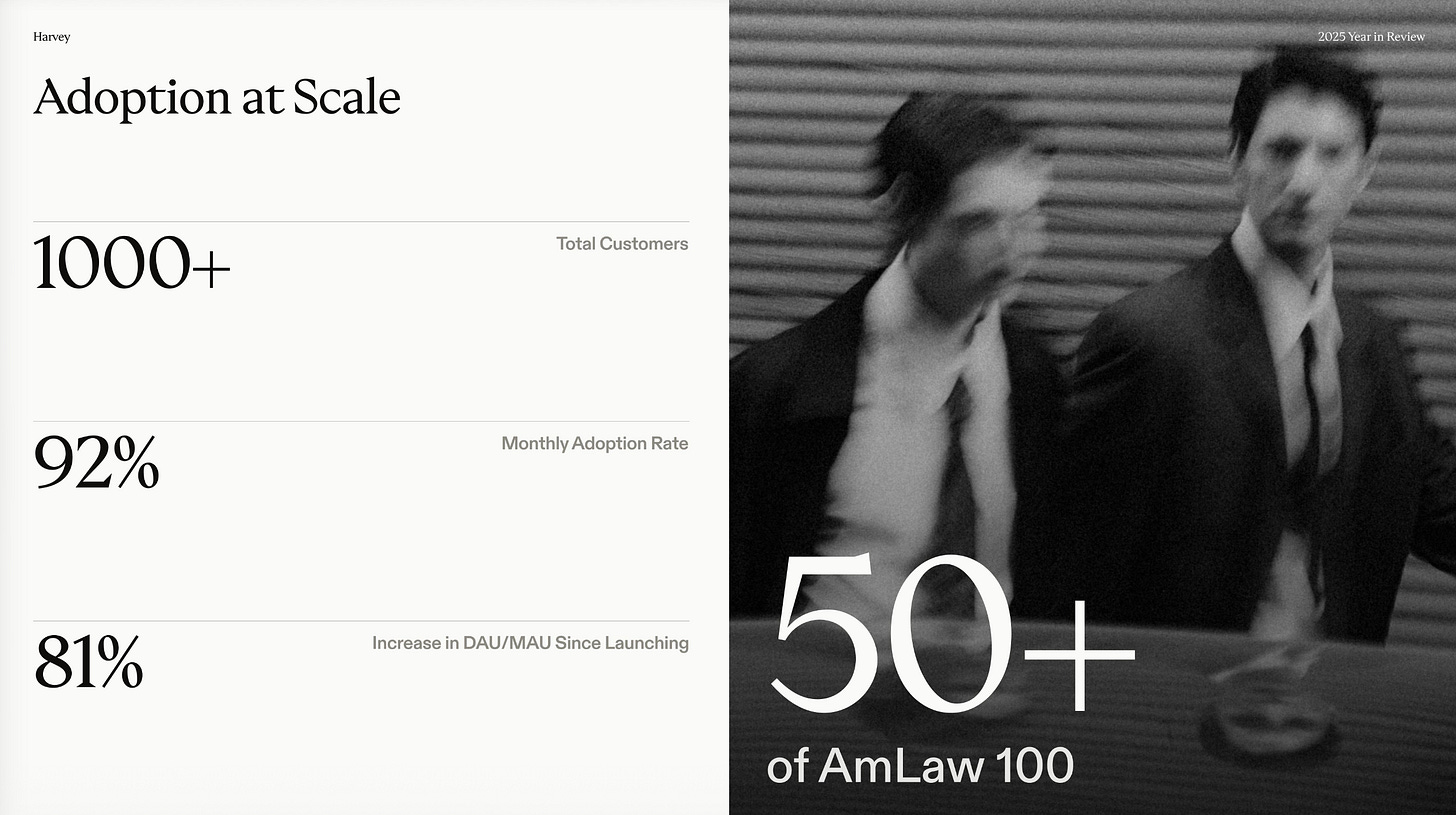

2025 was the year Harvey moved from emerging technology to essential infrastructure. With more than $190M in annual recurring revenue, adoption across over 50% of the AmLaw 100, and 1000+ customers across 59 countries, Harvey became the system professionals rely on to think, decide, and deliver with greater precision.

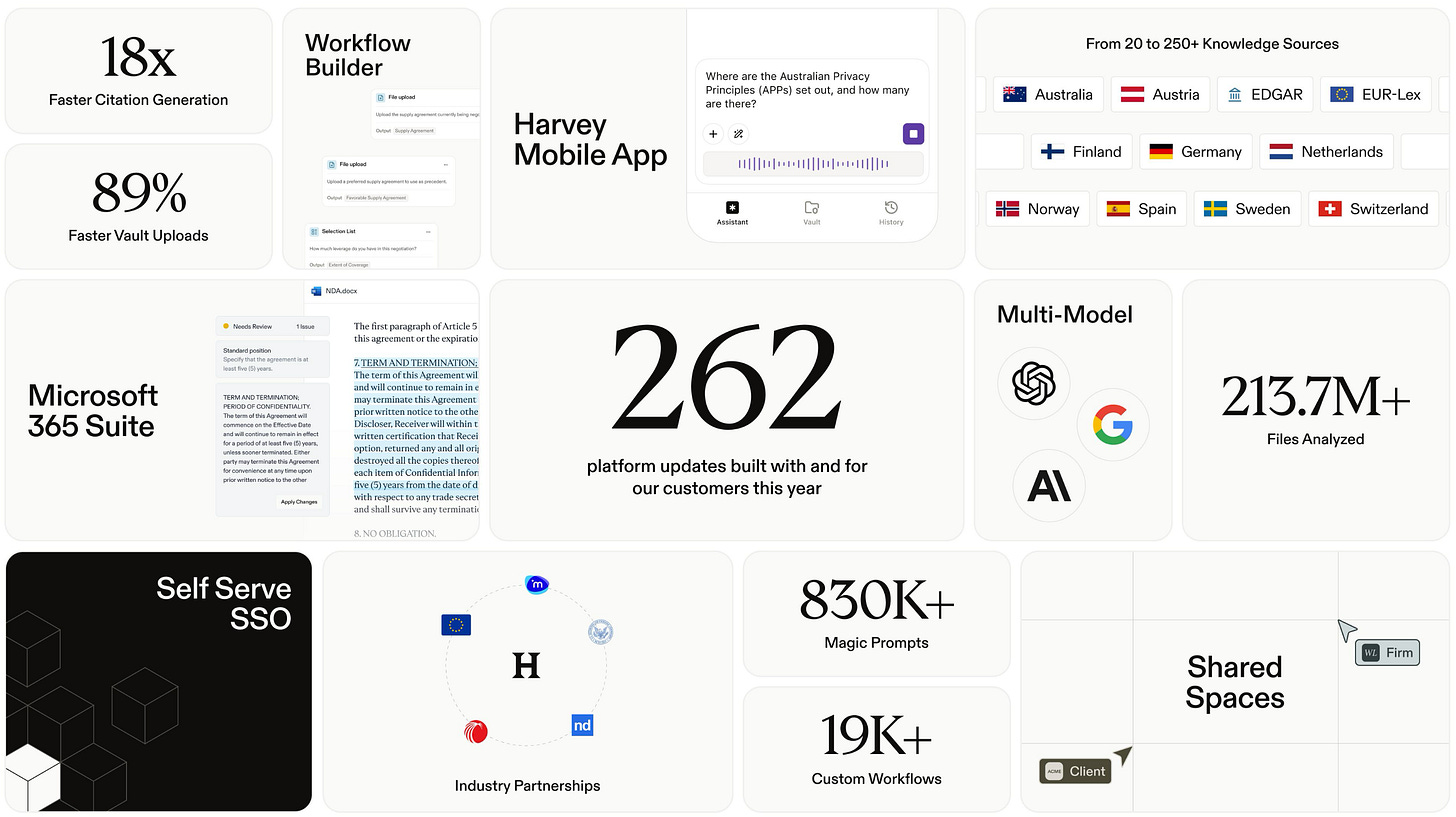

Our team surpassed 500 employees as we launched 262 new capabilities and expanded globally. The platform grew faster than ever, becoming the daily companion for thousands of experts, and a catalyst for the world-class work they produce.

$190M ARR for legaltech kinda says it all. Ironclad, one of the companies considered to be an outstanding success in legaltech, last reported around $150M ARR at the beginning of 2025, and they’ve been in business for 12 years. Not to point out the obvious, but there is a significant opportunity for Harvey to aggressively enter the practical SaaS aspects that Ironclad provides.

Interestingly enough, they’ve not only scaled to 1,000 individual customers (I think having a large number of companies in their install base makes sense due to the “partnership” nature of those orgs), but also to customers in 49 different countries. One of the biggest benefits of LLMs is the ability to adapt them to a variety of languages and deliver a very similar experience for the end user. Reasoning has been crucial to this, since it allows for more iterations in finding the right intent in the local language, compared to traditional “word-for-word” translation workflows.

Still, just as Ironclad and other legaltech companies have some of their largest installed bases among in-house legal and commercial teams, Harvey has been able to break through in those accounts as well. So what is the actual platform?

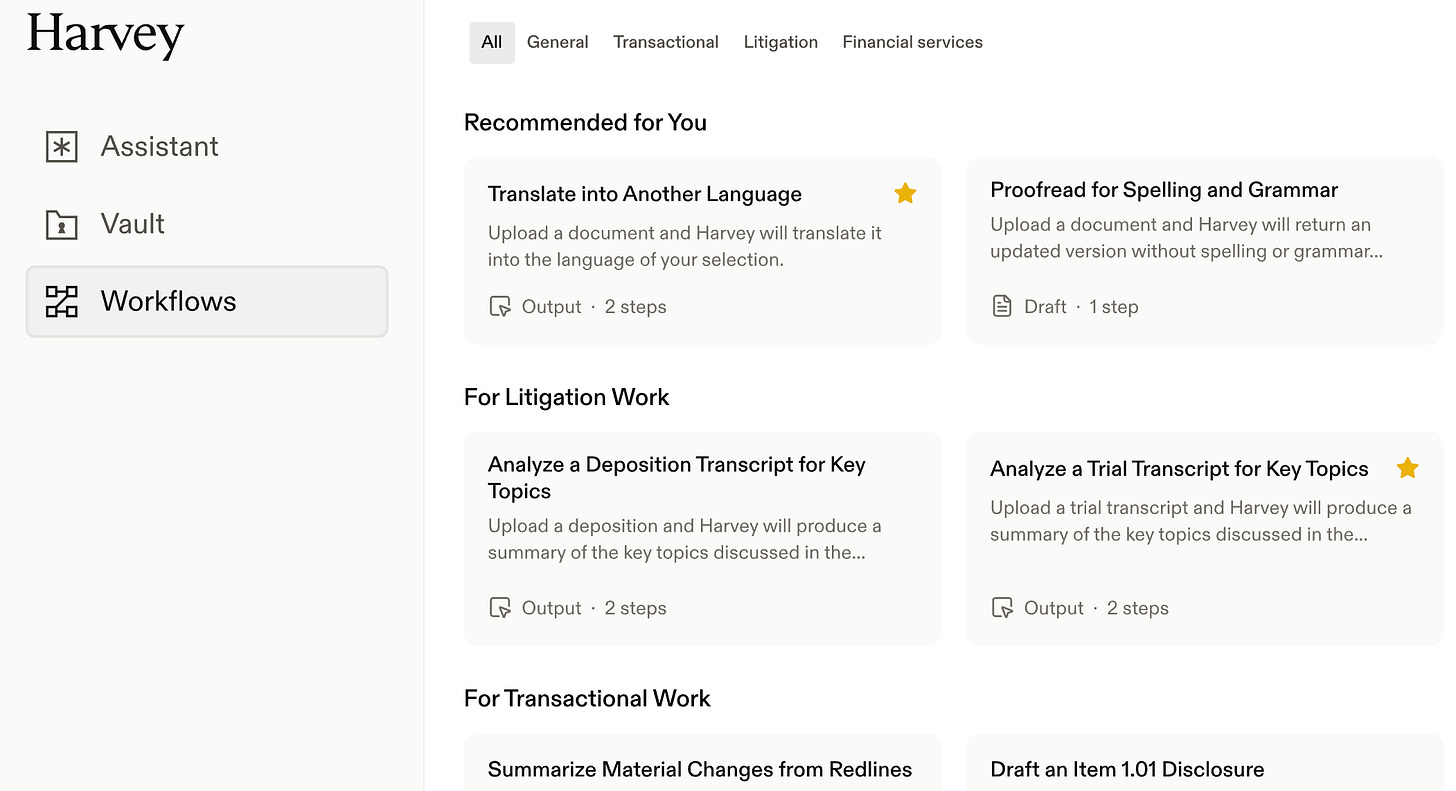

There are the core AI features we would expect: Assistant and Knowledge (which is essentially deep research functionality). Harvey lets users choose from a variety of LLMs in order to avoid churn due to user preference for different frontier models. From a UX perspective, I think this remains a challenge in the context of vertical AI, in the same way that the model switcher is confusing in ChatGPT and most users have no idea what it means.

The SaaS competitor features are Vault and Workflows. The latter competes directly against tools like Ironclad, while Vault goes after companies like Box. These are complementary features for the audience that Harvey is trying to serve. Ultimately, the ideal workflow to capture “all” of legaltech can be described as:

Create the paperwork and be able to dynamically redline.

Store the final versions in a secure manner that’s still available for reference on short notice.

Automate repeatable tasks in order to serve the internal customers of the legal teams.

Sign the documentation.

The last part is something that is not yet in place for Harvey and is arguably a low margin effort (DocuSign has been in a race to the bottom on pricing, with multiple companies trying to enter the category), but it’s a logical step and one that they can actually innovate on if they lean into the idea that the future of AI is APIs and agents. In my view, the future of legaltech is going to be driven by logs, not PDFs in emails. This is not likely a direction they’ll pursue in the short term, since most of the vision here has been modernizing existing workflows rather than being especially creative.

Where Harvey seems to have improved is in branding and what we can call DevRel, but in practice is, um, LegalRelations? Basically, one of the biggest perceptual challenges the company faces is a) AI is slop, and b) AI will steal my job. Reframing customer expectations by being likable, engaged, and focused on improving their lives is critical in order to overcome the inherent resistance from this target audience.

Not surprisingly, customer stories focus on Harvey solving mundane and annoying tasks.

I think this is a pretty critical part of their success over the year: framing the company as an enhancer rather than a disruptor of the legal profession. This was not the most obvious move at a time when plenty of AI-native companies are trying their hand at offering a complete replacement for the vertical functions they are trying to automate. The leadership has been prudent in this positioning, which might or might not bite them in the long term (Harvey does not collect or train on any of the data they process, which means that whenever they end up launching a “lawyer agent,” it’s a bit unclear what their real edge will be besides a lot of experience building harnesses around frontier models).

Speaking of technical progress, it’s been a busy year for the team as they’ve raced to convert their funding into a market-leading position. It’s not surprising that there have been a significant number of PRs (pull requests) based on collaborations with their customers. The quantified benefits that Harvey seems to be aiming for in their customer stories do not actually “just happen”; somebody had to work with those teams to ensure adoption and then drive feature requests internally that would help the customer scale.

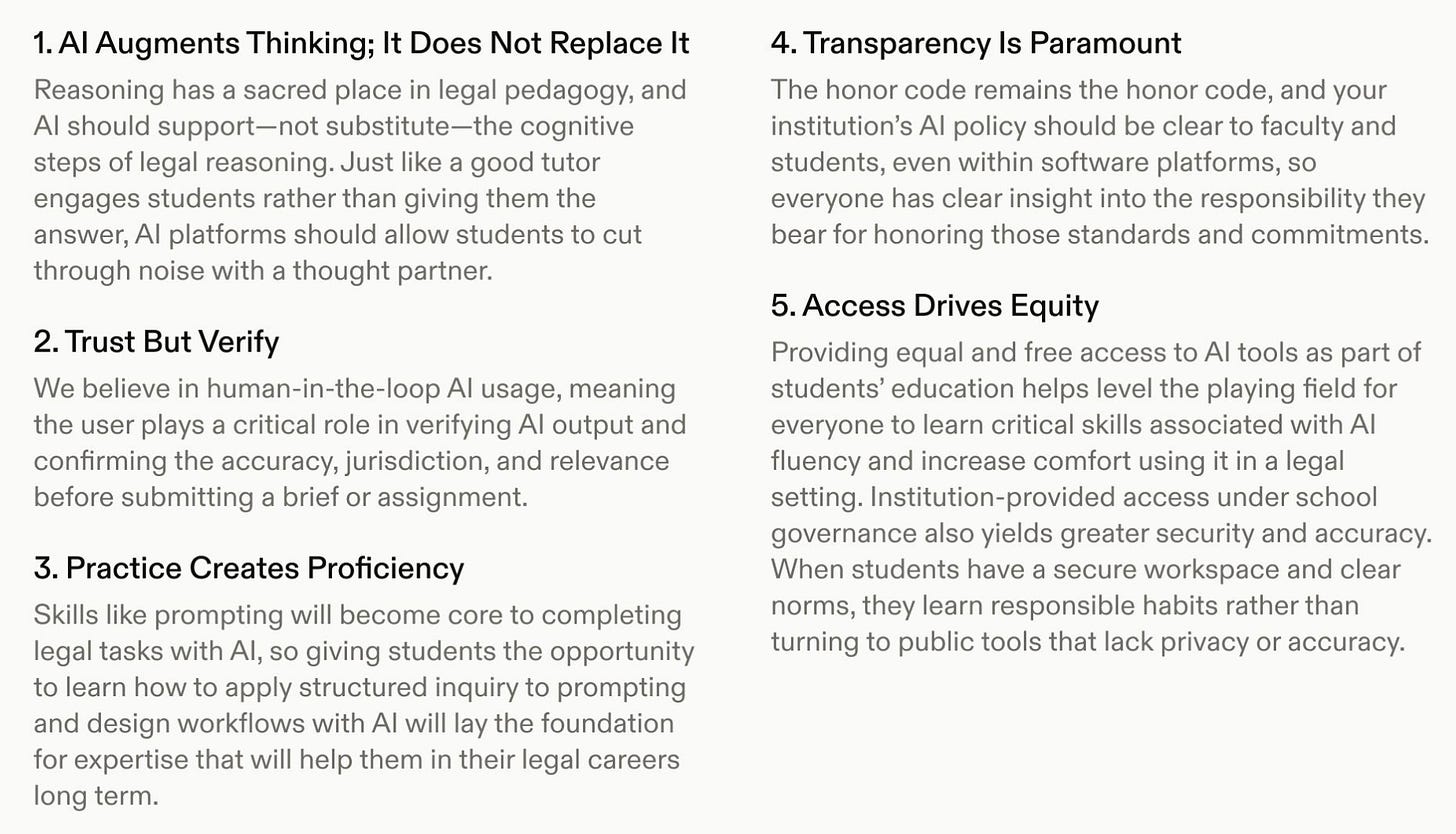

If we try to understand the philosophy of the team today, their framework for providing Harvey for free to legal students in top law schools gives us some ideas:

If we take this at face value, the company’s vision for the future of legal teams can be interpreted as: “AI will be part of everything that you do, but ultimately your job will exist because there will always be a premium on human judgement.”

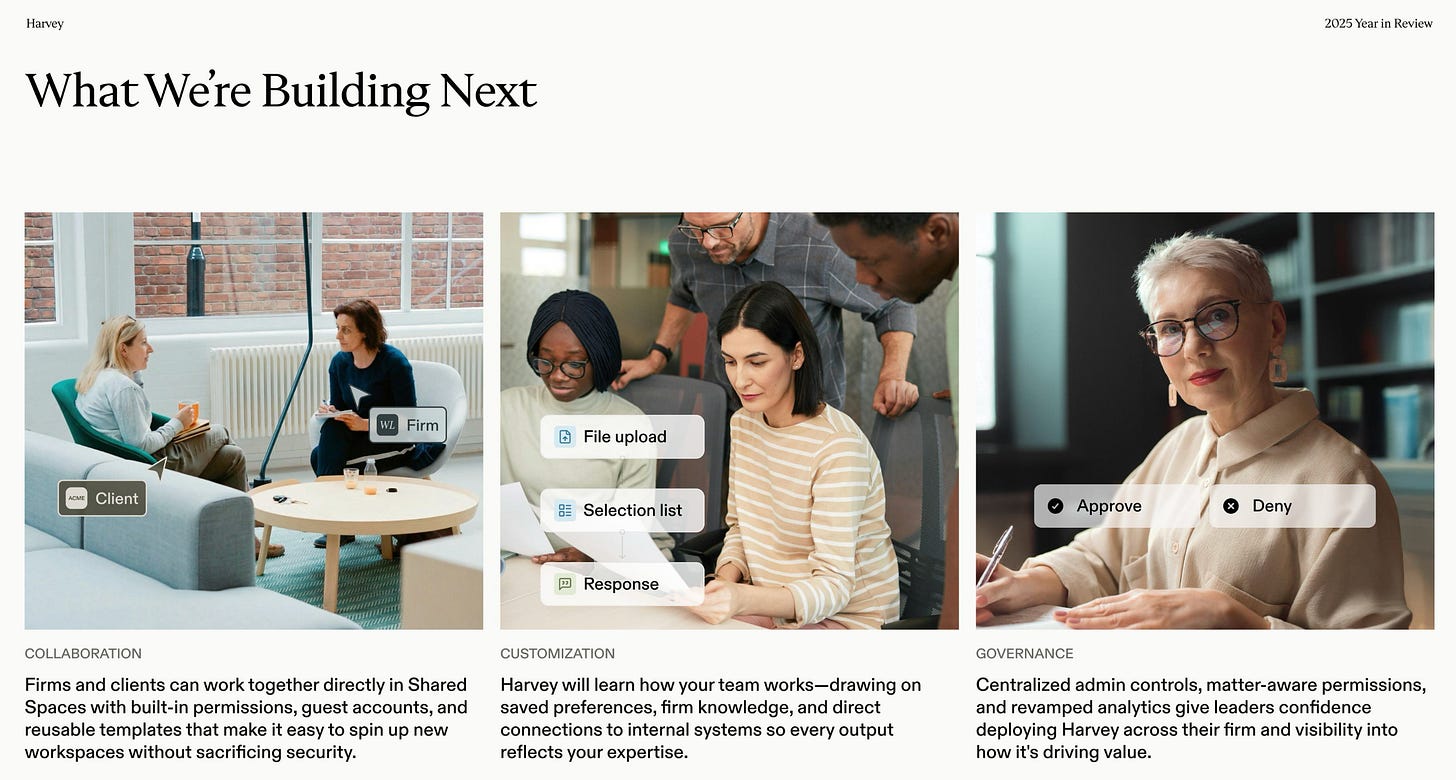

So where is Harvey headed? On the product side, it looks like they want to compete with the Microsoft 365 moat on collaboration and redlining. This is a logical step, because to make the product sticky, it needs to become ingrained in most workflows that legal reps have.

We started Harvey because we believed AI could have a disproportionate impact on legal and professional services. People were skeptical at the time that lawyers would use AI at all.

Three years later, more than 50% of the AmLaw 100 use Harvey for Legal AI, alongside top legal teams from Fortune 500 companies. The question has fundamentally shifted from “will lawyers use AI” to “which legal teams will adapt the fastest using AI as a catalyst?” We’re fortunate to be partnering with the world’s best legal teams to help them prepare for the future of law.

But we aren’t stopping there. Harvey has a Law Schools Partnership program that partners with faculty, staff and students at law schools around the world to build AI into their curriculum and to provide free access and training with Harvey. The long-term mission for Harvey is to increase access to justice, and we’re starting by partnering with the Singaporean courts and educational institutions globally to make Harvey and legal AI more readily available to everyone.

We’re building a platform, but we are also building a company and a community of legal and professional services leaders who believe in safe, responsible use of AI to make work both more efficient and effective. This also means returning the legal field to its original purpose of apprenticeship, ideally making work that has become incredibly monotonous infused with significantly more meaning.

That meaning is important to us too—we know the best people in the world want to work for companies with a clear purpose, and that the best organizations in the world want to partner with organizations that stand for something. Harvey is proud to do both.

From a vision perspective, they are trying to communicate that Harvey should essentially take over most of the mundane work and leave the most challenging and interesting work to humans.

Now, this covers how the company tries to present itself. Let’s take a look at the practitioners and sales reps working there.

I have (a) been watching the space with interest and conducted an extensive analysis for my previous law firm, when we were considering GenAI tools; and (b) discussed with colleagues who used Harvey at their previous firm and were deeply unimpressed.

Harvey appears to be a heavily overpriced (a) pretty UI; (b) prompt library; and (d) RAG tool, wrapped around API calls to Foundation/Frontier models. It is aggressively marketed to law firms, and aims to charge up to US$300 per user per month, including punitive minimum user numbers and lock-in periods. At my last firm, along with the Global Managing Partner, and Chief Technology Officer, I was on the receiving end of Harvey’s sales pitches. Their belligerent tactics aroused my concerns and cued me to spend several months investigating their product.

For comparable capability, direct foundation model access costs US$16.80-30 per user per month (Google is $16.80; Claude Teams $30/month). Harvey’s pricing represents a 10-20x mark-up. This premium theoretically purchases specialist legal features and workflow integration. Their refusal to provide any demonstration or trial periods however reinforced the many warnings we received from multiple sources that they were snake oil salesmen.

They have considerable and increasing competition from tools such as Legora and Iqidis - and, for firms willing to dispense with the superficialities of Office integration - direct use of Foundation/Frontier models. For example, Quinn Emanuel use Claude, and Freshfields use NotebookLM/Gemini. Both appear to be (a) more powerful; (b) more flexible; (c) advancing faster; and (d) cheaper/better value than so-called specialist “legal AI”.

The reasons Harvey is the best known platform so far are:

Prestige. Bamboozling high profile firms first, which meant that other firms assuming that the ‘first movers’ knew something they didn’t (in fact, I think it was the opposite: the first movers were simply the first firms to be fooled, and were henceforth used as bait to lure others into Harvey’s trap).

Fear. Implying, or stating outright, that only getting special ‘legally flavoured’ tools would protect client data. This is garbage. All of the [main three] Foundation/Frontier models are SOC 2 certified.

Ignorance. Most equity partners wouldn’t recognise GenAI if it hit them in the face, much less understand it, and therefore they are astonished when they see any old crap from Harvey.

FOMO. Not understanding the area, not employing anyone who does understand the area, but being desperate not to fall behind competitors.

Copilot is garbage. Finally, Microsoft Copilot is truly, deeply awful, and so compared to that anything looks decent!

Personally, I think legal AI is a bubble, led by Harvey (as opposed to AI generally, which I think has considerable potential, including for law firms). The strategic objective appears to be to achieve market share and lock-in by forcing their way into as many law firms as possible as quickly as possible, in the hope of increasing prices yet further later, once lawyers’ arms are in the mangle, and Harvey have made them dependent. I suspect Harvey will struggle as Foundation/Frontier models continue to advance rapidly, and user awareness and understanding of GenAI tools increases.

Ouch. Pricing for Harvey seems to be a serious point of contention, particularly since they do not use the most expensive models like those in ChatGPT Pro. There are also many smaller legal firms that the sales reps didn’t seem interested in engaging with. Let’s look at why that might be:

Toxic work environment fueled by fear and distrust. Leadership, including the inexperienced founder, struggles with setting clear direction, leading to constant instability. Employees—hired at premium salaries for their expertise—are micromanaged and treated like entry-level reps. The founder prioritizes money over people and fails to foster a healthy culture. Poor board management results in unrealistic targets, with board members stepping in as de facto operators. High turnover and constant fear of termination make this a company best avoided.

Overall, Harvey is an intense place to work, and the culture can feel toxic at times. The mid-market team is noticeably less toxic than enterprise thanks to stronger leadership, but the fear-based environment is still very present. Quotas for mid-market are also extremely high, which adds to the pressure.

Extremely toxic, but you can make money if you’re willing to put up with constant anxiety and never being good enough.

Not ideal, to say the least. As a counterpoint, the last two reviews on RepVue are glowing recommendations, but in a way that rather contradicts the consistent feedback given previously:

Harvey is the first place I’ve worked where the team is both genuinely ambitious and genuinely supportive. I came in hungry, and instead of ego or territory, my peers immediately pulled me into their world by sharing plays, helping on deals, and celebrating every win like it mattered to all of us.

The product makes the job exciting. Prospects get it quickly, the market momentum is real, and you can feel how early we still are. It’s rare to join a company with this kind of traction this soon.

It’s fast-moving and intense, but if you’re someone who likes working with smart people, big goals, and a team that actually wants you to win, Harvey is a pretty incredible place to be. I’ve really loved it here.

Now, there might be a reason for this wave of negativity:

I’m at Harvey and happy. Harvey introduced levels and performance reviews this year, and many of the angry people did not like what they got. Other angry people include people who were hired to do one thing but ended up having to do more of another thing. I have been at toxic companies and this company is anything but truly toxic.

So to summarize:

Harvey has been aggressively pursuing the goal of building a leading legaltech solution that covers most of the workflows in which AI can play a strong role in optimization.

Their last raise ($160M) valued them at $8B, which is quite a heavy valuation for a company that is not actively trying to build a moat with its own models, but is instead trying to create a network effect by implementing mostly useful SaaS features that their customers are asking for.

The big push to reach this funding round caused significant pressure internally, both on the sales and engineering teams. In the middle of the year, Harvey also introduced a more formal organisational structure, which was disruptive but probably a necessary long-term pain.

The sales motion is focused on BigLaw and larger “mid-market law” accounts. The price per user seems to be the highest in the industry and might become unsustainable in the long term.

$190M ARR clearly indicates strong product-market fit. Whether growth sustains is a different question.

I think Harvey is a strong example of a vertical AI play, but it also shows how chaotic building a company can be on top of frontier models. There are obvious risks and benefits to this approach, with little predictability as to how things might turn out in a few months.

Ultimately, the only important question is whether this solves real problems for its customers and does so at a price point they perceive as acceptable.