Infra Play #98: The AI job is not finished

Practical look into AI Agents

In this article, we will go through the Coatue “East Meets West“ conference deck (EMW 2025). It’s one of the most interesting analytical pieces that come out of the VC world because Coatue itself invests in both public and private companies. This helps alleviate some of the bias that comes from focusing on a “single stage” in the lifecycle of a company and requires more first-principles thinking.

Read the full thing for the 2030 forecast of top 40 companies.

The key takeaway

For tech sales: The tech sales opportunity in AI and cloud infrastructure software is unprecedented. Currently a lot of it is concentrated in private companies, which means that reps need to adjust their career strategies if they want to take full advantage.

For investors: The most interesting and high growth opportunities today are not available for the majority of investors. This is one of the few periods in history when companies that should’ve been public by now are instead able to fully scale and operate with private funding. While this will hopefully change over the next 12 months, it’s also an indication of a shift in the playing field.

The AI supercycle and other bullish themes

Source: EMW 2025

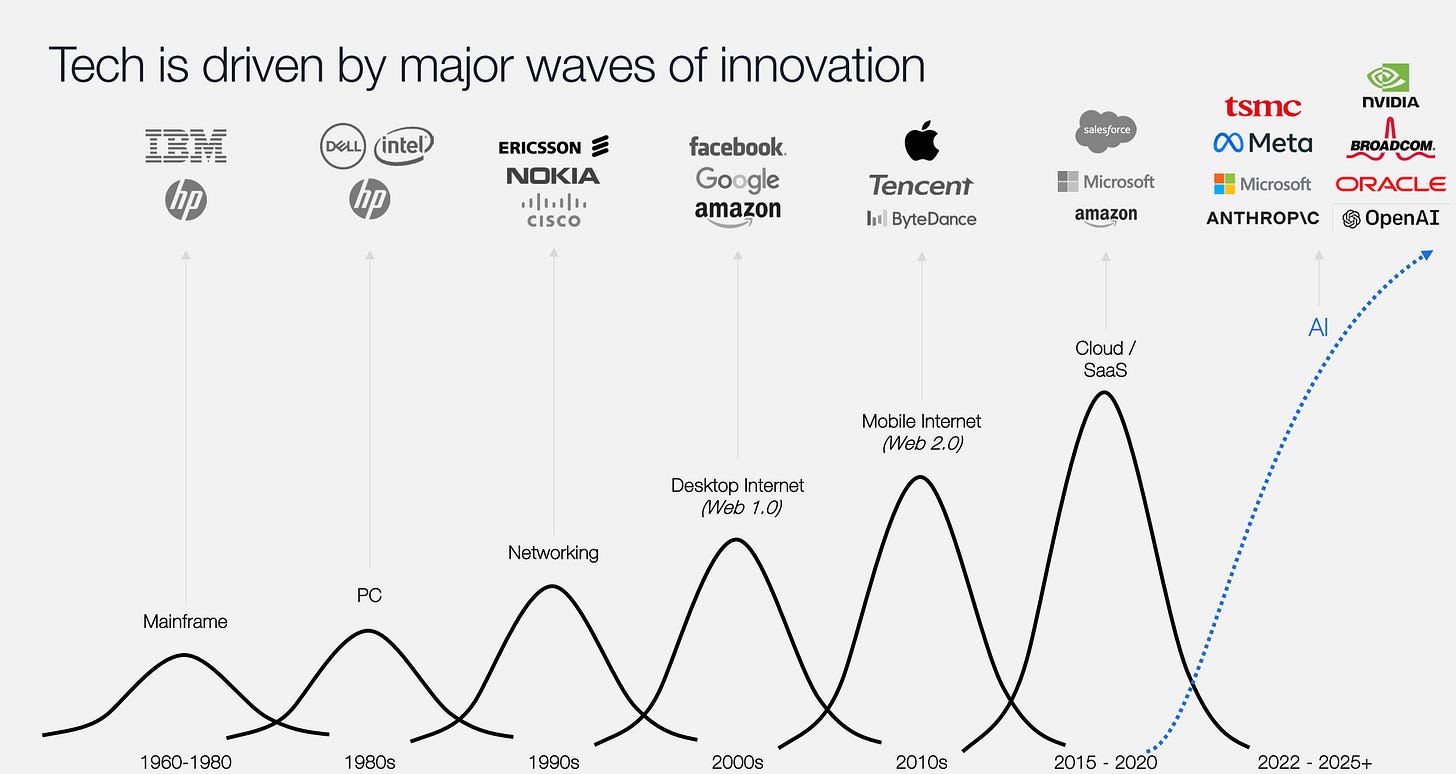

One of the interesting parts of tech growth has less to do with the triggers in technology, but the fact that each wave is bigger than the previous one, partly because it benefits from the distribution and value creation of everything that preceded it. The AI play is often misunderstood as a “new product”, when in reality the market potential is so high partly because it allows for much deeper penetration and productivity from the already existing computing infrastructure that we have today.

Source: EMW 2025

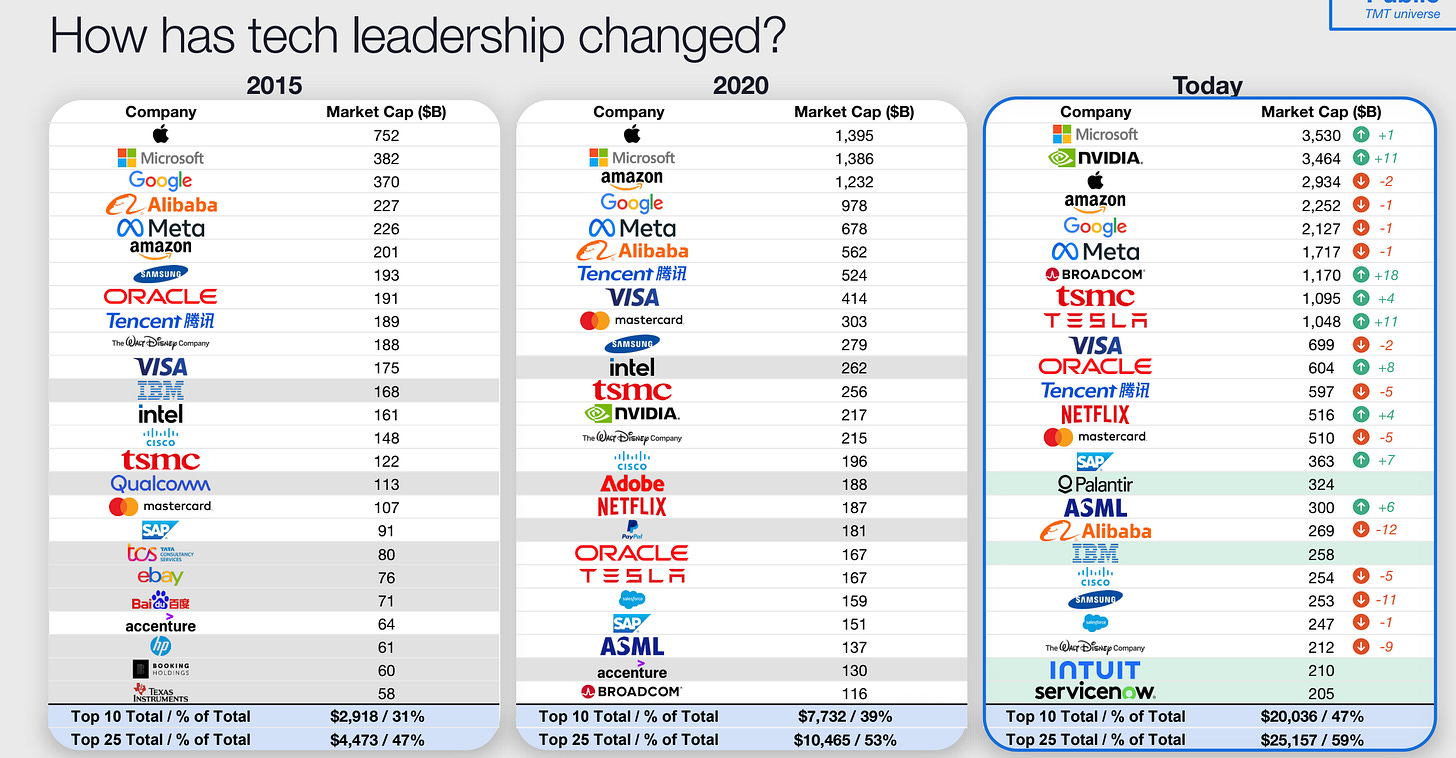

The market cap share of the top players today compared to 10 years ago is significantly larger, with substantial multipliers even when compared to 5 years ago. The growth in the technology sector has been exceptional, with the majority of the value concentrated in cloud infrastructure software.

Source: EMW 2025

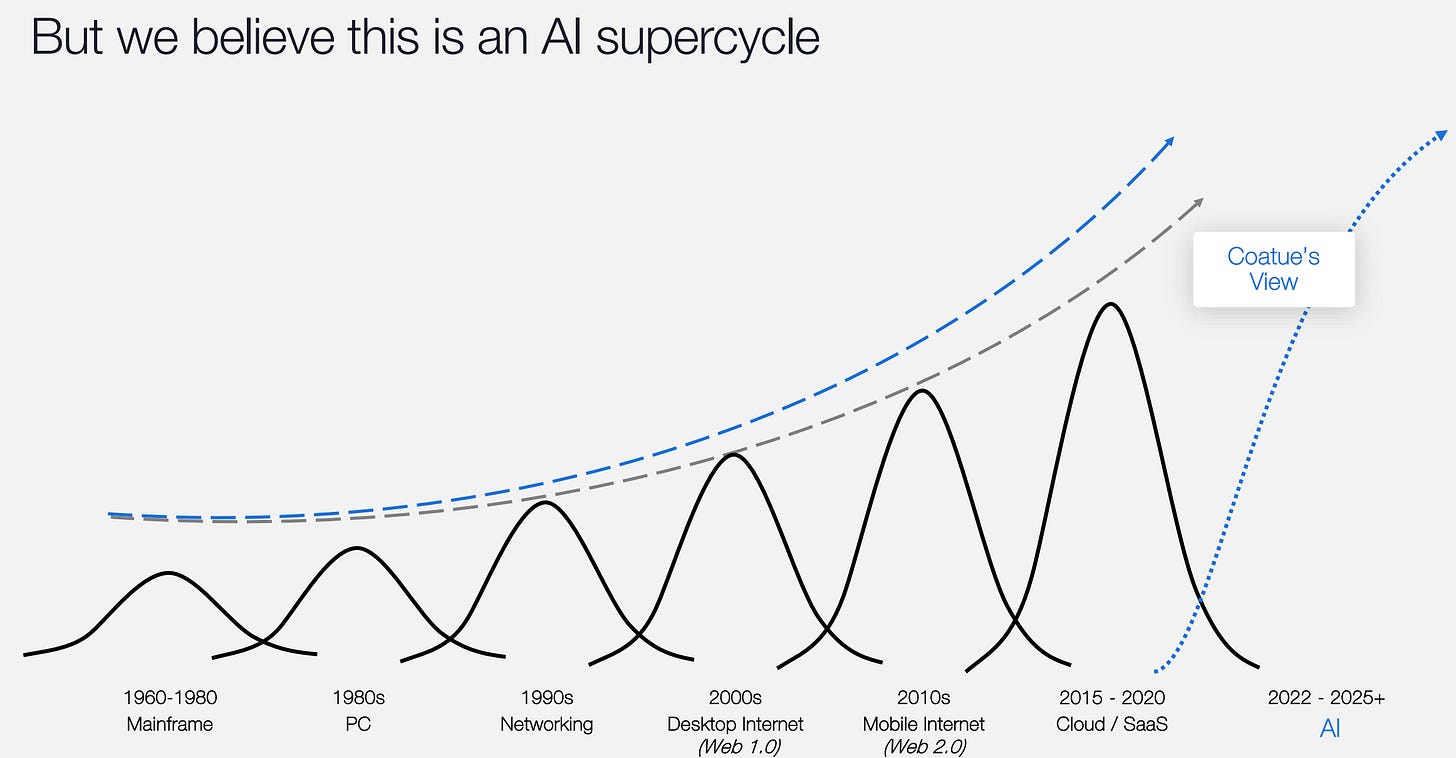

Now the supercycle concept here is an interesting choice since it represents a very narrow mental model focused on the idea that investing in this cycle will have outsized returns compared to historical cycles because we will see significantly larger growth before the next leg of innovation (whatever or whenever that might be).

The argumentation, however, is weak if only fixated on the mental model of investing. So let’s contrast this with the recent talk by Andrei Karpathy at YC: