Infra Play #128: Is SaaS dead?

Getting the direction right is not an easy job

At the end of last week's deep dive on Salesforce, I added this quote from an experienced investor on the personal impact when a "sector dies":

This period of time in SaaS reminds me of the living hell that is running a hedge fund when a sector dies and you have exposure.

1) You wake up, reach for your phone, see your stocks are down pre-market for the fifth day in a row on no news. Good morning!

Go get a bacon / egg / cheese and coffee from a deli - this will be the only good thing about your day and you know it.

2) Enter the office and your SaaS analyst has a grimace on his face. You don't want to have the same conversation you've had in your head and with him 30x a day for the past week so you just go eat your breakfast at your desk while reading news / research.

3) Your analyst comes in and you have the 121st version of the conversation. No new insights. You can sense he is beaten up so you go through 50 mental model / frameworks but neither clarity nor comfort arrives.

4) Morning meeting with the investment team.

Someone will invariably ask "So what's our view on this sector?" [meaning the sector that is equal to hell on earth right now]. This kicks off a conversation in which the other analysts who know absolutely nothing about the sector in question will start by asking gently probing questions of you and the analyst. This escalates to unanswerable questions that people only have the nerve to ask when a sector is dead. You have to graciously entertain these questions because the stocks are down so apparently anything goes. You start thinking that everyone in the room is stupid including and maybe mostly you.

After 20-30 min of abuse (maybe more) and at the point where you literally have no clue what you're even talking anymore ("when will this turn?), someone will mention that their buddy works at a rival fund where the PM sold the entire sector earlier that week. Another analyst will then mention "That fund is really smart" (implying you are stupid with which you agree wholeheartedly).

5) Meeting over. Now you and your analyst have another conversation, and you can see the fight leaving his body. You wonder how his physical body remains upright seeing as the spine is dissolving in real time but then realize you're not a doctor because you're not smart enough. Anyways, this chat may or may not culminate with the suggestion that "maybe we should take some off or just come back later". At this point, your brain floods with the history of your interactions including how the two of you have patiently been waiting for a "buying opportunity" JUST LIKE THIS. And now that it is here, didn't immediately go up, and, in fact, went down further, you are having to contemplate trimming or selling. You restrain yourself from smashing something but also understand your analyst who doesn't want to destroy his year by January 16th and die like this. Who does?

6) At this point, you realize you are simultaneously fighting 1) the market, 2) your primary analyst, 3) your other analysts, 4) your competition including QQQ which only goes up. And you feel very, very alone in this investment. No joke, this part truly sucks.

Most times, you probably trim some of whatever is hurting. Because at least you did something. And if it all goes to hell, you can sell more and say / feel you took the right action. And if it goes higher, well, at least you somewhat stayed. Honestly, at this point, no one will give you any credit for your actions anyways and you're just going to get whatever potential discredit results. It rarely pays or is feasible to be the hero here.

7) Day is almost over. 10 minutes to close or maybe right after, your largest, most "proactive" institutional investor like Blackstone will email "Hey - got a second to chat about Saas?". Or maybe your most unsophisticated investor. Usually both. So then you hop on the phone and explain what you know, what you think and what you did or plan to do. This is the point where having a 10 out of 10 investor like Blackstone helps because they are professional and get it so long as you are sticking to your process.

8) Go workout and feel a bit better. Go home and try to be present with the family for a bit. Then whiskey time and mentally go over everything again. Alone. To make sure you hopefully aren't impairing capital permanently and, if so, have a plan.

And that plan is to fire everyone and become a monk.

Besides being very entertainingly written, it captures the current level of anxiety and uncertainty around what we would call the “digital natives”, businesses that built a large install base of customers by providing vertical cloud solutions, often completely abstracting the technical layer behind them.

Their strength relied on productizing technology in a way that most regular companies would simply not be able to do, or where it was not prudent to invest in trying to replicate the off-the-shelf offerings of those SaaS players.

The massive growth that those companies experienced, however, did not come without trade-offs. Part of the reason why famous investors like Buffett never ended up investing heavily in the sector (outside of a $570M punt on Snowflake during their IPO, which he mostly exited in 2025) is that those companies often had inferior business practices from his point of view, particularly when it came to profits and shareholder returns.

The “value investing” thesis has mostly disappeared in the last 10 years, particularly as retail flooded the public market. The last bastion of institutional control is the opening hours of the main stock exchanges and the algorithmic preferences built there for institutional investors. As FT Alphaville covered it:

Woo! Tokenised trading experiences!

NYSE’s proposal follows a similar request to regulators from Nasdaq in September. Both exchanges talk up potential benefits, such as streamlined clearing, though there’s an acknowledgement that stock trading would be spicier if it looked more like crypto. Michael Blaugrund, vice president of strategic initiatives at NYSE’s parent company, ICE, tells Bloomberg that tokenisation “will create new opportunities for retail to participate in the stablecoin-funded markets that have attracted their attention”:

“We think it aligns with the retail investor’s emerging desire to be able to trade something at 5:04 p.m. on a Saturday and then use that money to buy something else at 5:05 p.m. on a Saturday,” Blaugrund said. “This would facilitate that trade in a way that traditional equity infrastructure cannot.”

Sure, instant settlement is nice. What’s nicer is that, when it’s 5:04pm in Dallas, the sun is rising in Hong Kong and the pubs have just closed in London. Perpetual trading invites the drunk and bleary-eyed to vibe-trade an informational void, on bid-ask spreads so wide the liquidity providers can run on autopilot. All of which is fine. Why shouldn’t stocks trade like crypto and FX? Punters want to punt, so let them.

One risk is that professional investors will feel obliged to join in. Out-of-hours liquidity improves, volatility flattens out and trading edge evaporates. NYSE and Nasdaq broaden their duopoly. No one gets enough sleep.

There have been plenty of retail successes in recent years, where certain stocks outperformed most participants in the market, particularly those who avoided sentiment investing and focused on “stable foundations.”

This is not to say that running a scalable and profitable business is not a priority, but it is important to note that what some perceive as poorly managed businesses (particularly when it comes to SaaS vs. alternatives) can still make a lot of sense for the context that the company operated in.

The big question, of course, is not how things used to be, but where things are going. Whether they like it or not, poor stock performance will always impact the employees of that company, often in more drastic ways than desired.

This week we will review the thesis on SaaS of Avenir, as outlined in their “The Future of SaaS: Fork in the Road” white paper.

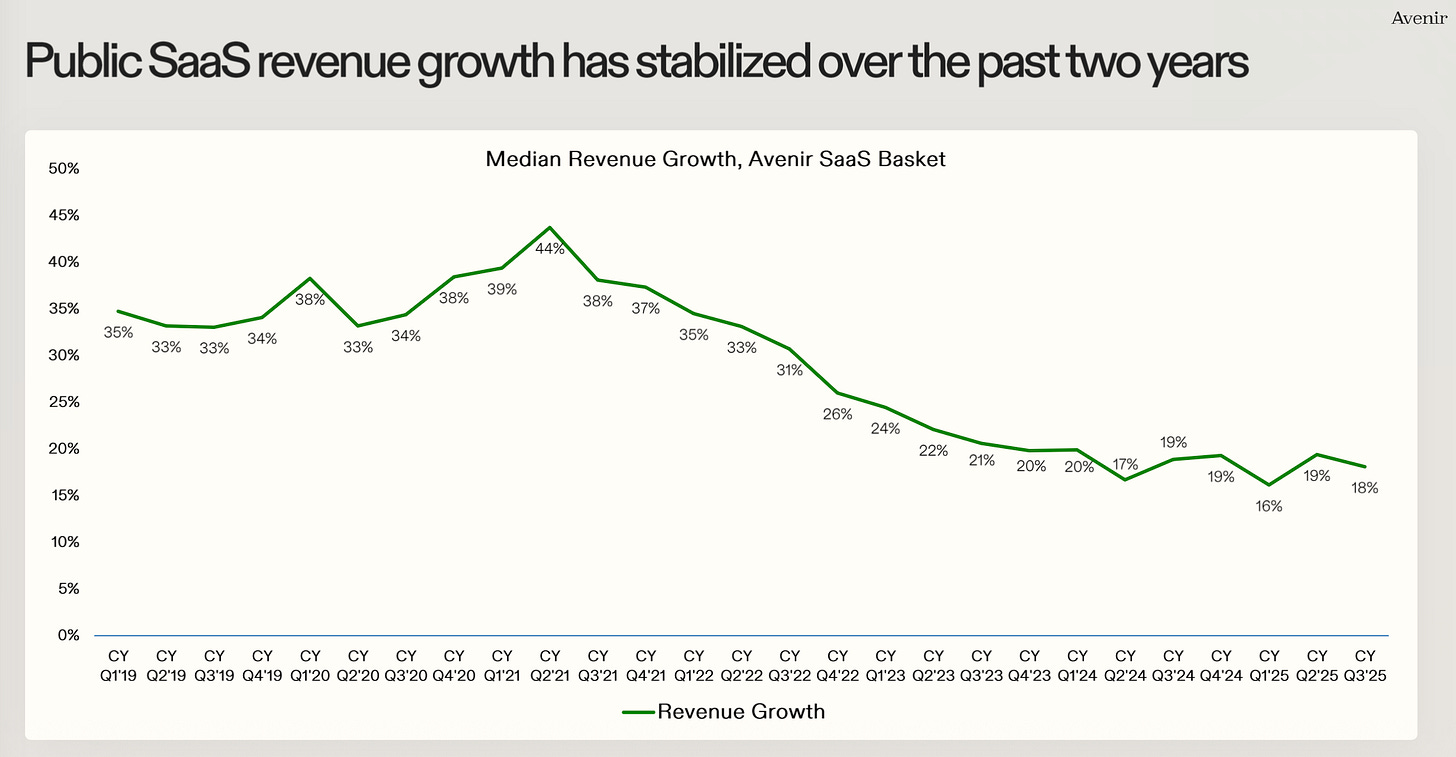

This should not come as a surprise to the readers of the Infra Play, but when it comes to growth for most public software companies, we peaked at the height of the COVID bubble and have struggled to regain growth. For most of ‘22 and ‘23, this was driven by the “workload optimization drive”, when most companies realized that they were badly overspending on tech and started reviewing their usage and doing the hard job of optimizing data footprints and configurations.

Once the AI wave started, the expectation was for things to come back to high growth.

This did not happen. I repeat, this did not happen.