Infra Play #127: Sales...force?

How far the mighty have fallen.

Salesforce is the #1 AI CRM, where humans with agents drive customer success together. Through Agentforce, our suite of customizable agents and tools, Salesforce brings autonomous AI agents, unified data, and Customer 360 apps together on one integrated platform to help companies connect with customers in a whole new way.

Two years ago, the conversation about AI was framed from the perspective of the significant advantage that SaaS incumbents have due to their large data estate. The interesting thing is that this advantage was seen from the perspective of relational data, such as customers, communication records and ordering information.

I had significant reservations around this thesis because value in cloud infrastructure software accrues to the bottom of the stack. The hyperscalers, frontier model labs and pure play data platforms looked much more likely to monetize the opportunity, which would’ve been a significant change in the market dynamics, where vertical SaaS dominated in profitability and growth in the previous decade.

The Salesforce leadership was aware of this, hence their attempt to push the “data platform” angle of Salesforce and try to get customers to consider using them also as a data warehouse. They also dipped their toes in trying to train models, with Marc proudly announcing that there is no moat to the work that OpenAI and Anthropic were doing.

Let’s see which directional bet played out.

The key takeaway

For tech sales and industry operators: Salesforce's strategic confusion reveals the core question every enterprise software company must answer: are you building a definite future or defending an indefinite present? The way that Marc Benioff discusses his business is a masterclass in indefinite optimism where every customer is a friend, every product is beloved, every metric is exciting, but there's no coherent theory of why Salesforce specifically wins the AI transition versus being commoditized by it. The "last mile" argument that enterprises need context, metadata, and deterministic workflows is actually an argument for data platforms like Databricks and Snowflake, not for CRM vendors who happen to store some customer records. The "unlimited enterprise license agreement" strategy is particularly concerning because it pulls forward revenue while simultaneously training your best customers to demand steep discounts. If you're selling against Salesforce, your window is now: their reps are exhausted, their quotas are unrealistic, and the "unlimited" deals they're closing are creating a cohort of customers who will churn violently when renewal comes and the promised ROI hasn't materialized. If you're selling for Salesforce, understand that your job has fundamentally shifted from solution selling to political air cover.

For investors and founders: Liquidity continues to be pulled from public SaaS into private markets toward AI-native companies, and Salesforce illustrates why. How much is this business actually worth if you value it honestly as a declining enterprise software company with a distribution advantage but no technology differentiation? The entire thesis rests on inertia, and inertia is a wasting asset when the underlying paradigm shifts. The bull case requires believing that large enterprises will permanently delegate their AI strategy to their CRM vendor, which is a theory of enterprise stasis that has historically never played out. The install base is valuable, but it's valuable like a declining oil field: you can extract cash flows, but the reserves are depleting. The three pricing pivots in twelve months (per-conversation → per-action → unlimited enterprise) show very little trust in the product-market fit of Agentforce, and each pivot trains customers to expect deeper discounts at renewal. If you're founding a company, the opportunity is to build the "anti-Salesforce". This would be a system designed from day one for AI agents to operate rather than humans to click buttons, with pricing aligned to outcomes rather than the consumption metrics that drove those panicked pivots. The goal should no longer be to manage customer relationships but to autonomously optimize customer outcomes, with humans providing oversight rather than operation.

AI CRM and other delusions

Marc Benioff: And we’ve delivered incredible results with Agentforce, it’s really exceeding our expectations. We’re going to hit all the details, but I think that you can see 3.2 trillion tokens delivered for our customers. It’s all exceeding our expectations. We’re going to get into all of that detail as well. That’s the core of our organic innovation. We’re making these discipline strategic acquisitions like

Informatica also now online in the company. We’re really excited about the harmonization, integration, federation that Informatica plus Data 360 plus MuleSoft is giving us, and that’s going to strengthen our overall leadership and data and, of course, AI. And we’re ensuring that we have the distribution capacity, that’s extremely important for us because we are a direct seller, in place to support long-term growth. And Miguel has made some fantastic investments over the last 12 months in all of our core segments and we’re going to talk about that as well.

…

Now, you are all at Dreamforce. You saw that energy, the level of customer success, it exceeded my expectations. And you saw how we’re bringing humans, data, AI, apps together to build the agentic enterprise. And we just couldn’t be more excited about that and how customers are receiving the message. Every CEO I met at Dreamforce, and I mean, every CEO I speak to just in the last couple of days, I had some great meetings and I’ll tell you that everyone knows that they want to get to the next level in their business, to bring AI in, become more productive, become more efficient, become elevated, as Matthew said in the opening video. But they all know they’ve got to become these agentic enterprises. And I don’t think for a lot of them, two years, three years ago, maybe even a year ago, they really understood that opportunity. And they are now more motivated than ever to do it. We’re going to hear about that, some great stories from the quarter.

And of course, we’ve all read that crazy MIT study where customers went off trying to build their own models and trying to build their own toolkits and this and that and DIY it. And now they realize the real value from AI is delivering, number one, customer agents. And we have so many examples, but now I think about $500 million in Agentforce revenue, talking about customer agents.

But also what’s really exciting here at Salesforce, and some of you have seen it, but probably a lot of you haven’t, is employee agents. And we’ve really delivered an incredible new framework, deeply integrated into our Slack product. Every Salesforce employee already uses it every day I do. And it’s the core of every demonstration we give to our customers to show how we have unleashed with Slack something new called Slackbot, which is really the heart of our employee agent strategy. And you’re going to see that, it’s incredible. It is able to go not only through Slack and not only through the whole internet, but also through all of our customer’s data that they have basically provisioned in a secure way through Salesforce as well and deliver a context.

And I’ll tell you, and now before I do a customer visit or call or whatever it is, although I’ll just kind of sit right down ... I was with a really good friend of mine just this weekend. I had lunch with him and he’s a top venture capitalist and he had been a huge investor in a Coinbase. And I’ll tell you that we were just sitting there just talking about, “Hey, tell me about everything with your venture capital company. Tell me everything about this venture capitalist, and then also tell me everything about Coinbase and the company and our relationship.” And then bam, it’s able to deliver to me absolute and complete, not only analysis, not only a summarization, not only all of the detail, but next steps, how to sell, what I should do exactly for the customer. And I love demoing this to customers because they don’t think it’s possible.

And then when they see it, they say, “Wow, this is what AI was meant to be. “ And I’m like, “This is context. This is data. This is apps. This is the best of the large language models and delivering it all to you. “

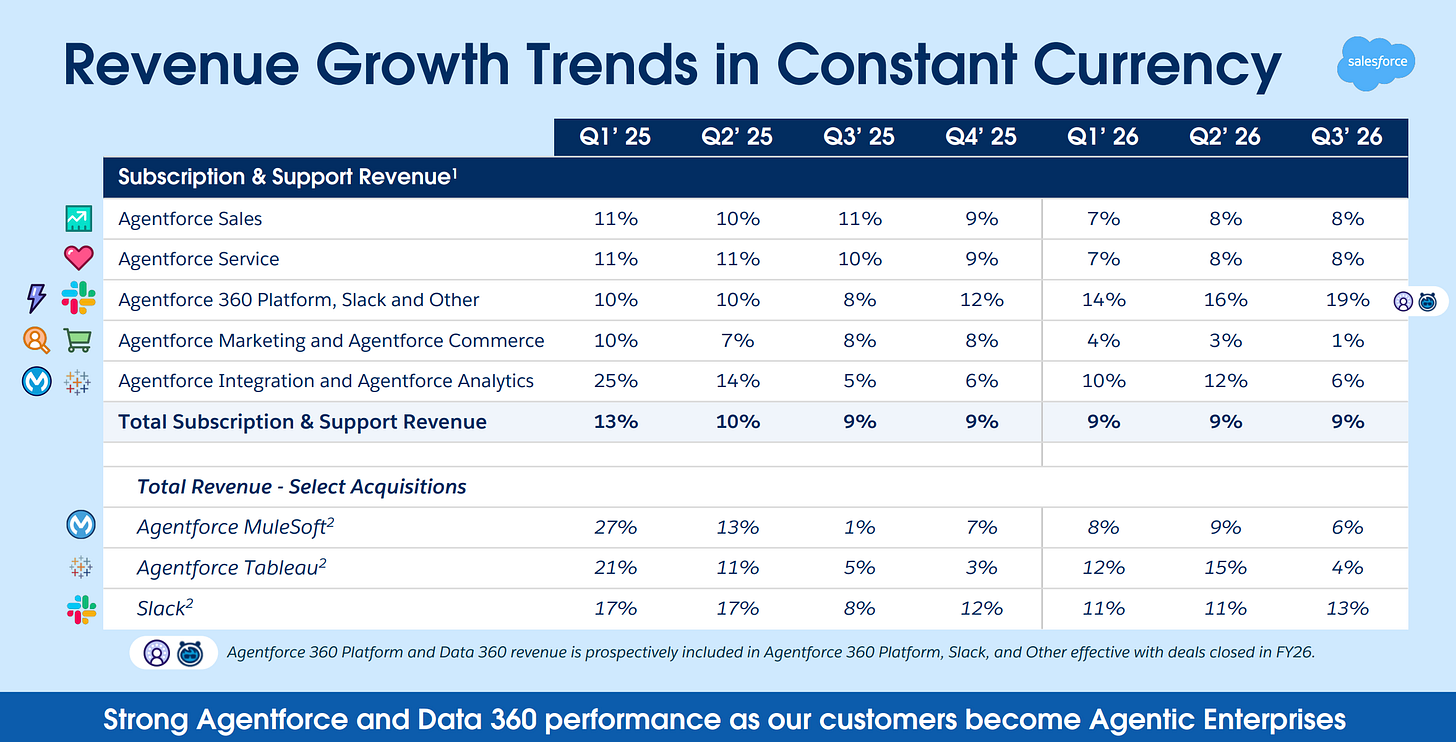

The quotes in this article are taken from their Q3 earnings call back in December. During the call they forecasted around 11% growth, from which 3% is driven by the Informatica acquisition. This means that Salesforce is going to 8% growth in its core business, which means growth is further decelerating unless propped up with acquisitions.

The businesses where the company is seeing anything remotely close to high growth are their Slack business (which has cemented itself as a cash cow that everybody hates but most companies with high bills have issues displacing it because of the network effect that creating shared Slack rooms with customers has) and the Data+AI business.

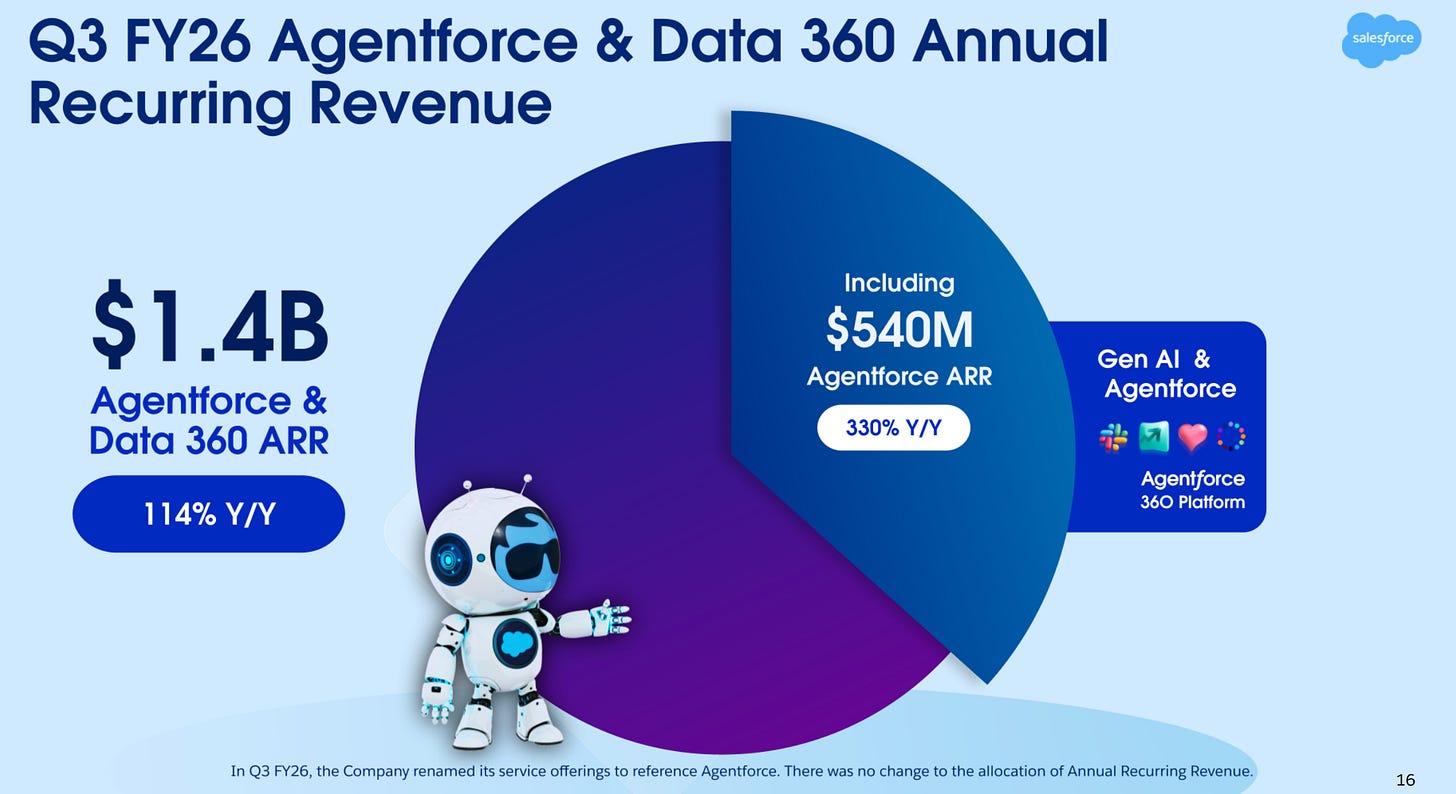

After making a significant push in rebuilding the internal business units with Agentforce dedicated capacity, the company is able to demonstrate high growth in the segment. Is this driven by delivering a best-in-class product, benefiting from the latest innovation of the frontier labs?

Well, Agentforce went through two major repricing strategies in the course of the last 12 months.

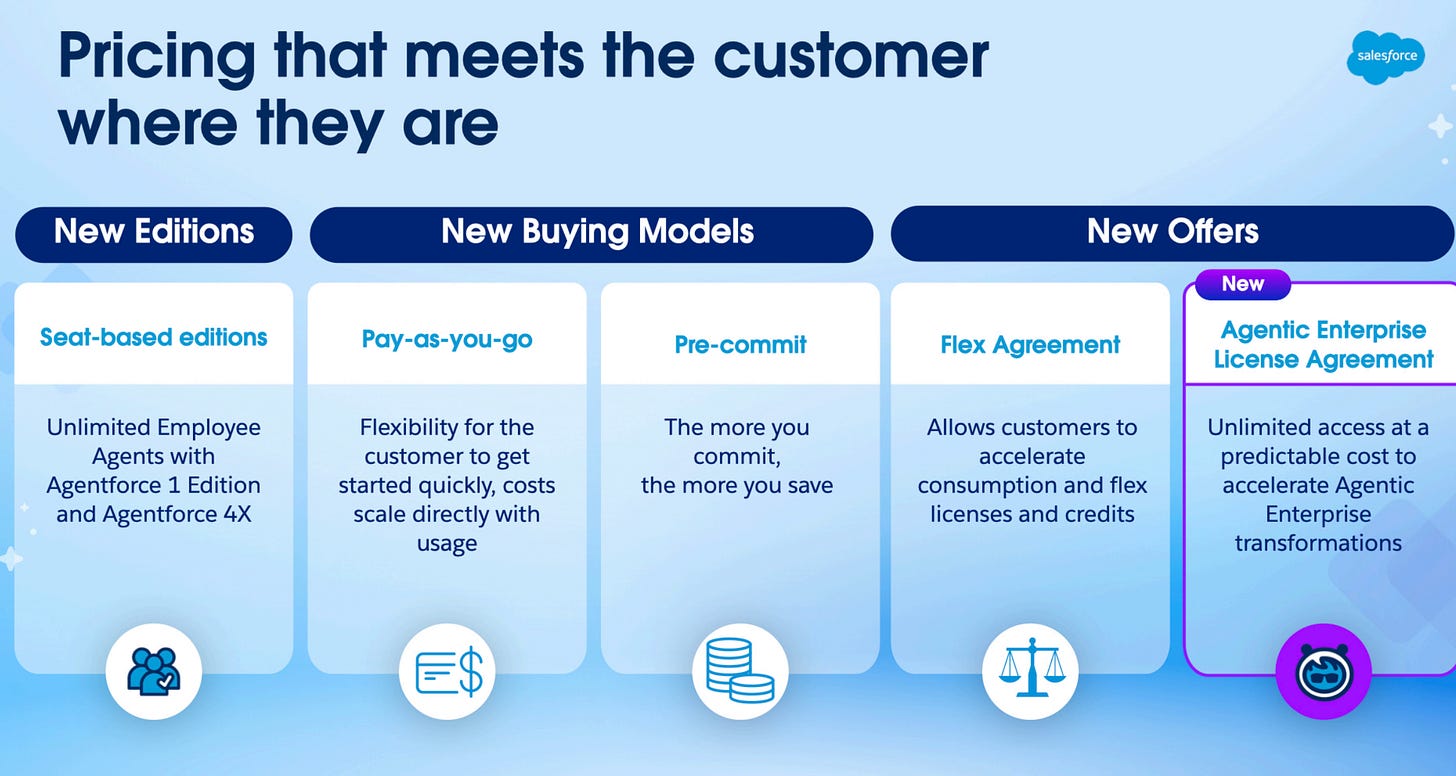

Originally, they debuted with a $2 per conversation metric, which was met with wide backlash from the install base, who struggled to understand when and how things would be counted as “conversations”, or how this could possibly be a fair price. Agentforce was positioned as a premium product and it failed at it.

The next step was to introduce a variety of ways to pay for it, centering around the idea of credits based on actions. While the price was lower ($0.10 per “action”), large enterprises were still rejecting the platform, as they were used to predictable, fixed-cost engagements with Salesforce. Ultimately this evolved to its latest positioning, where the teams charge a high price per user for unlimited actions, with the sales leadership having a generous discount allowance to drive adoption.

The crown jewel is the good old "fully unlimited Enterprise contract", a previously retired relic from the good old days of Oracle and IBM. Getting very creative with how low they were willing to go in order to sell Agentforce led to the 330% growth figure for investors, but at what cost?