Infra Play #123: ServiceNow

The best managed Enterprise SaaS company in the world?

One of the first deep dives I did on this newsletter was #25 and it was all about ServiceNow. At the time (late January 2024), they had just finished their fiscal year at $8.7B and were growing 30% per year. At the end of that article I concluded:

ServiceNow appears to be running a well oiled machine that's going towards another year of 20%-30% growth in 2024.

The executive leadership is involved and proactive.

The product has a great market fit.

They literally have 24 out of the 24 largest financial organizations as customers.

A large install base from all sectors of the economy.

Their average big ticket ACV is $4.5M.

Even if you are unlucky with your territory, the opportunity is clearly there.

In two weeks they'll finish their fiscal year and probably hit around $12.8B of revenue at 20% growth. They have an outstanding renewal rate, some of the best margins in the industry and essentially a monopolistic hold over "real Enterprise IT".

So why does it feel as if ServiceNow is failing the AI Era?

The key takeaway

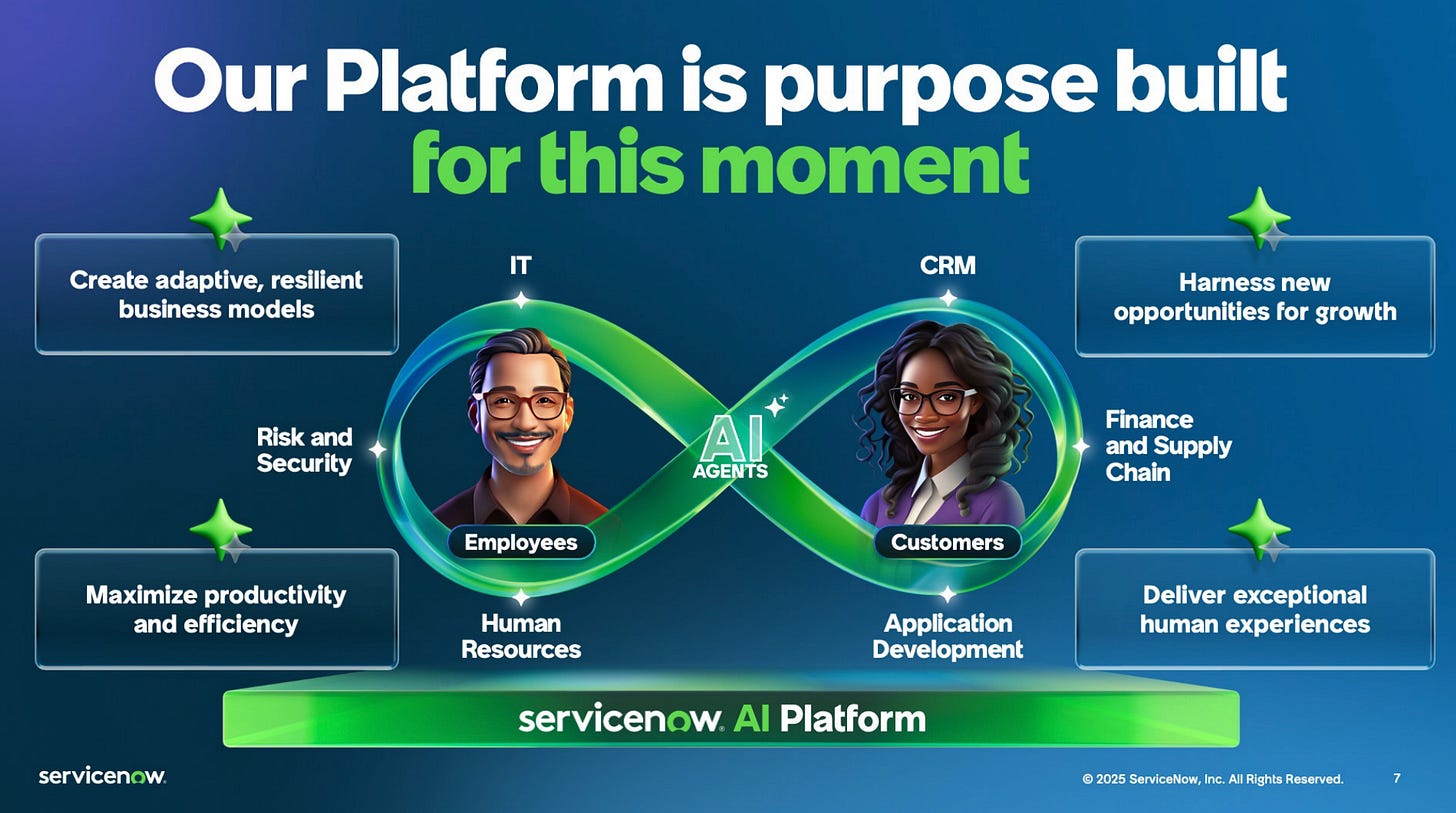

For tech sales and industry operators: ServiceNow had a genuine monopoly in IT Service Management for enterprises too large and bureaucratic to adopt modern tooling. This was a valuable secret about the real state of corporate IT that they exploited brilliantly for fifteen years. The more recent expansion into CRM, HR, finance, and security however feels more like a desperate horizontal sprawl of a company that knows its core monopoly is eroding. In sales, you should be asking whether you're selling a definite vision of the future or just another incremental improvement. Currently the only forward-looking story that isn't upselling workflows is the AI Control Tower governance pitch, which at least attempts to position ServiceNow as the neutral layer enterprises need to track, audit, and control AI deployments across fragmented vendor relationships. The entire premise of no-code workflow automation for IT assumes humans remain the primary operators. Once AI agents can interact directly with APIs and backends, the graphical interface layer becomes unnecessary middleware that adds latency and cost without value. The main durable competitive advantage is the switching cost embedded in thousands of automated workflows that would take 18-24 months to replicate elsewhere, which means your job is selling insurance against disruption rather than transformation. The unfortunate reality is that ServiceNow has become a company that is struggling to get 70% of its reps to 70% of quota attainment, which says a lot for both its wider market opportunity outside of the "whale accounts", as well as the clear approach of "your commission is my margin" financial planning.

For investors and founders: ServiceNow is essentially betting that CIOs will choose governance and compliance overhead over velocity and capability, which may be true for a cohort of extremely risk-averse organizations but represents a shrinking addressable market as AI-native companies gain share. The interesting contrarian question is whether "AI governance layer" could become the new monopoly. If every enterprise needs a single system to track, audit, and control all their AI deployments, ServiceNow's positioning could be prescient rather than desperate. However, this requires believing that enterprises will choose a neutral third party platform over their hyperscalers' native governance tools, which seems unlikely given the consolidation of AI spending into Azure, AWS, and GCP. The acquisition of Moveworks for their "agentic" capabilities is an admission that ServiceNow's internal R&D couldn't build competitive AI products despite years of effort and billions in resources. For founders, the opportunity is building solutions that make ServiceNow's value proposition absurd: if you can offer direct API integrations, self-improving automation, and 80% lower costs, the "single pane of glass governance" story collapses. The disconnect is stark between a market that has dumped 27% of the stock this year and a leadership team insisting they're the "MAG8" and "the AI-defining enterprise software company of the twenty-first century."

In a league of it’s own

Bill McDermott: ServiceNow delivered another set of stunning quarterly results that absolutely shattered expectations. Subscription revenue growth was 20.5% year over year in constant currency, one full point above the high end of guidance. CRPO growth was 20.5% year over year in constant currency, 2.5 points above our guidance. Operating margin was 33.5%, three full points above our guidance. Free cash flow margin was 17.5%. We had 103 deals greater than a million in net new ACV, six of which were greater than $10 million in net new ACV. Technology workflows had 50 deals over a million, including six over $5 million.

ITSM, ITOM, and ITAM were all in 15 of our top 20 deals, with double-digit deals over a million. Together, security and risk combined for 12 of the top 20 deals with three deals over a million. That risk and security business combined is now a billion ACV business, our fifth business to cross the billion-dollar threshold. CRM and industry workflows were in 14 of the top 20 with 15 deals over a million. And core business workflows were in 13 of the top 20 with 14 deals over a million. Here’s the headline: ServiceNow is one of the most durable, consistent, overperforming growth companies in the enterprise software industry.

When you think about brands shaping the future, you have GPU leaders like NVIDIA, hyperscalers, foundation models, and one company integrated in altogether—the AI workflow company, ServiceNow. It used to be the mag seven, now there’s a new category. I’m calling this the super eight. That’s the mag seven plus ServiceNow. That’s right. The super eight. As you’ll hear from Gina, our confidence in the future has never been stronger. So we’re raising guidance again heading into the fourth quarter. This team knows how to focus, innovate for our customers, execute at global scale, and most importantly, how to win. We’ve only scratched the surface of the market opportunity for this platform.

That's an interesting statement. It appears that the MAG7 is being extended to add a new company. Is it OpenAI? At $750B potential valuation and $19B of revenue, it sounds like a company that we should consider for the new and improved MAG8.

Oh, wait, it's ServiceNow. The company that lost 27% of its capitalization value in the last year.