Infra Play #122: Snowflake

"Are we the losing incumbent, you guys?"

Ah, Snowflake. It’s time for a deep dive (and some chart crimes).

The key takeaway

For tech sales and industry operators: The question every Snowflake seller should ask themselves is: “What secret do I know about my customers’ data problems that Databricks doesn’t?” If you can’t answer that, you’re competing on relationships and price, which is a losing game as data platform needs became more sophisticated in the last two years. The aggressive acquisition strategy suggests management is buying capabilities rather than building them, which means your edge won’t come from platform superiority but from customer intimacy that neither corporate nor competitors can replicate. Specialist overlay roles (AI/ML, industry verticals) are where the real career leverage sits right now because the new CRO needs proof points to justify headcount expansion, and generalist AEs will be first on the chopping block. The shift to consumption-based comp plans is the most important change to internalize: your success is now measured by whether customers actually use what you sold them, not by contract signatures. This is the correct incentive alignment but requires fundamentally different skills than traditional enterprise sales. If you’re early-career, this is a trial-by-fire environment where you’ll learn enterprise data sales by losing deals to Databricks and figuring out why, with the safety net of brand recognition buying you time to adapt (but don’t expect the stock to carry your compensation). The uncomfortable truth is that your competitive win rate against Databricks field teams in your territory, and your ability to identify customers with high switching costs, will be your biggest indicator for long-term success.

For investors and founders: We should always be wary of management that spends more time explaining why they’re as good as the competitor than why they’re irreplaceable to customers. The zero-to-one question for investors is whether Snowflake can own “data collaboration” as a category; the Data Clean Rooms and sharing capabilities are genuinely differentiated, but they’re buried under messaging about competing with Databricks on AI. The contrarian bet would be that regulated industries (healthcare, financial services, government) will consolidate on Snowflake specifically because it’s not trying to be everything. These verticals value governance, auditability, and “boring” reliability over cutting-edge ML capabilities, which plays to Snowflake’s actual strengths rather than its aspirational positioning. This however requires Sridhar to have the discipline to say no to opportunities. His 17 years at Google and the recent acquisition spree seem to indicate this will be difficult. The very bearish case is if Snowflake becomes the IBM of data platforms: profitable, slow-growing, and irrelevant to anyone building the future. Paradoxically, founders should recognize that Snowflake’s desperation creates acquisition opportunities: if you build something that makes their AI story credible, you’ll get a premium multiple because strategic value exceeds financial value right now.

The current year

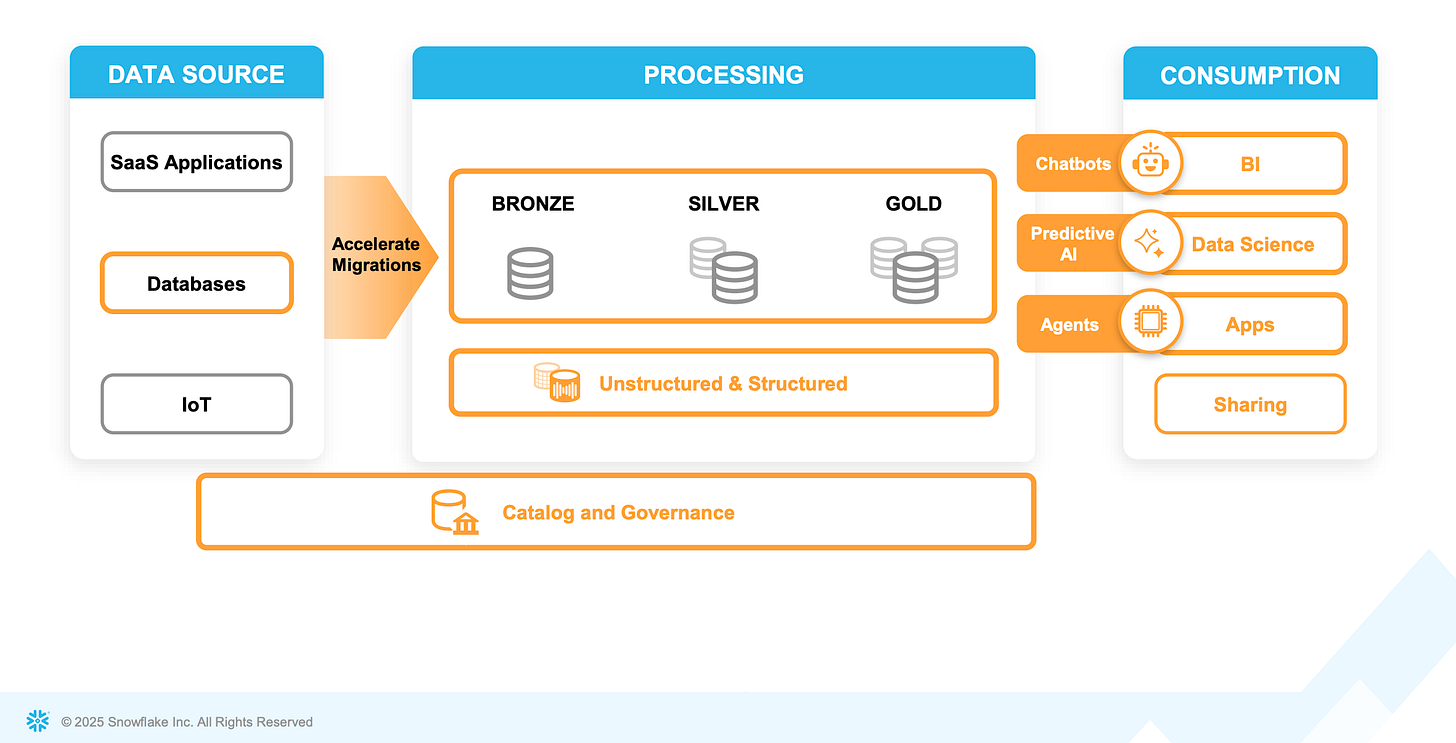

Sridhar Ramaswamy: And in many ways, my data team there was just as large as the product team. Accidental, but it influenced everything that we did. We built machine learning systems at planet scale, 20 years like ‘05 before -- like from now a decade before they became widely popular elsewhere. I think we are in a moment, where the rest of the world, thanks to AI, is waking up to the fact that data can transform how businesses can and should operate. And it is that movement from data as an afterthought to data is really important for you to get ongoing visibility and start predicting what you should be doing in the future in your business as many of our customers like Disney have done to do things like predict next best action to now thinking about, wait, AI can take this one step further. It can drive business transformation in a fairly fundamental way is what drives momentum for Snowflake and I know I speak for many of us at Snowflake that we feel very lucky to have this opportunity. And as you saw today, we are doing everything that we can to seize this opportunity with all our heads. There is a little bit of a schematic. It’s a caricature of how we think about what we call the end-to-end data life cycle. When is data conceived, typically in things like transactional systems.

When you open your app, that app sends a little message that says, “Aha! Sridhar opened this app.” It gets recorded somewhere. And so we see our like technical mission as being there at all key aspects of this end-to-end data life cycle when data is born, when it is ingested, transformed and cleaned and then when analytics is done on it and then the predictive analytics, where the history is used to predict the future then gets done on it. And what is also unique about this moment is this is the big unlock from unstructured data. You saw a ton of announcements today, whether it is Openflow or Cortex Search. That’s because unstructured data has always been a little bit of an afterthought in how people thought about data. It’s just too unwieldy. You couldn’t do that much with it. I joke to people were much in my life, Command F is my favorite PDF search engine. All of you write very nice reports, but God help me until recently, if I had to figure out, what did you actually say about Snowflake or a competitor. And -- but it is that unlocking where everything that we talk about, whether it’s data ingestion or cleaning or processing or analytic can now act on structured and unstructured data. And in a world where metadata and governance is going to be even more important. You have heard the phrase, AI-ready data, both in my keynote as well as Christian’s keynote.

Sridhar Ramaswamy is a bit of an odd duck in a sequence of odd ducks in the history of Snowflake. The company is known as the most successful example of a VC-incubated company, a concept that Sutter Hill repeatedly attempted to replicate afterward, with significantly less success. I’ve covered this dynamic previously in my Lacework deep dive.

Sridhar came through as part of Snowflake acquiring Neeva, his failed search-as-a-paid-service startup. He replaced Slootman, an industry legend who was falling behind in his later years and was widely rumored to be struggling with alcoholism. Sridhar previously was a key engineering leader behind Google’s search advertising business.

Sridhar Ramaswamy: It’s not enough to have data. You need to have additional information about what does it mean? And any of you that has done -- written SQL queries for a living or try to analyze data, knows that is super messy. I’ve spent thousands of hours analyzing data. And we always give like terrible names to all the columns. It’s really hard to figure out what the metrics actually are. It’s just like that’s sort of how it works out. You have a column called revenue, you don’t quite like it, you will come up with another column called Rev2 on the poor person that shows up 2 years later, it’s like who are these people and what did they do. And -- but having that layer of intelligence about that data becomes very important. And of course, finally, the world of consumption. This is roughly how we think about it. And when we talk about wanting to play a critical role for our customers into this end-to-end data life cycle. We talk about playing meaningfully in these different layers. So the product strategy very much over the past year has been, how do we release the key components that will let us play this meaningful role. Look, we understand that it is easy to say things like all users, all data. That’s an aspiration. That’s not a plan. And part of what Christian and Benoit and I and the rest of the team have been doing is be very methodical and deliberate about how do we attack this big opportunity? What are the critical first steps that we should take? And how do we always lead with strength? It’s easy to aspire to be something else.

It’s very hard to get there. If a set of companies have gone at some area for 10-plus years, it is not all that easy for any other company to catch up. And so I think it is really important that we have the big vision, but we are -- but that we are very deliberate in how we go about seizing that vision. And we’ll get into some detail later. But for example, in the space of databases and transactional stores, this is everything from recording a session that you’re having with a chatbot. Two, how do you have a user store that remembers preferences that a user has. We have taken steps. We’ve been working on something called Unistore for 5-plus years now. That’s meant to combine the best of a transactional store with analytics, clearly has turned out to be a harder project than we thought, but it’s up. It’s doing well and the acquisition of the, finally named Crunchy Data. It’s an amazing company, by the way. And when I first heard them out, like really you call Crunchy Data? But it’s a really good company, full of world-class Postgres developers.

It gives us an important component in how we go after this transactional market. And another component is how do we make it much easier for people to ingest data into Snowflake into cloud storage. That’s the data Volo acquisition that happened 6 months ago. We have brought it at record speed to public preview. That’s another thing that I want to stress, which is we are leaning much more into being effective with acquisitions, getting them out to market, getting that feedback, getting that happy loop of delivering customer value and iterating from it. We think Openflow is going to make a meaningful dent in how people look at us when it comes to getting more data in from existing systems, sometimes legacy systems. And Openflow is also much more even between unstructured and structured data. As I said, unstructured data is, I think, it’s a massive unlock in many different areas. And then we continue to invest very heavily in the bronze and the silver layers. These are the earlier stages of data processing. Previously in many of my conversations, Christian and I have talked to you about how paradoxically Iceberg was the Aha! moment for us a couple of years ago about what Snowflake could do in earlier stages of the data pipeline. We continue to invest very heavily in things like Snowpark, how do we make sure that we are seen as best-in-class when it comes to early-stage computation.

Snowflake’s success was built on providing a modern SaaS interpretation of what a proper data warehouse should look like, at a time when companies were starting to seriously consider moving to cloud and developing a “big data” strategy. In the period of 2012-2019, Snowflake aggressively displaced on-premises workloads across Teradata, Oracle, and IBM Db2.

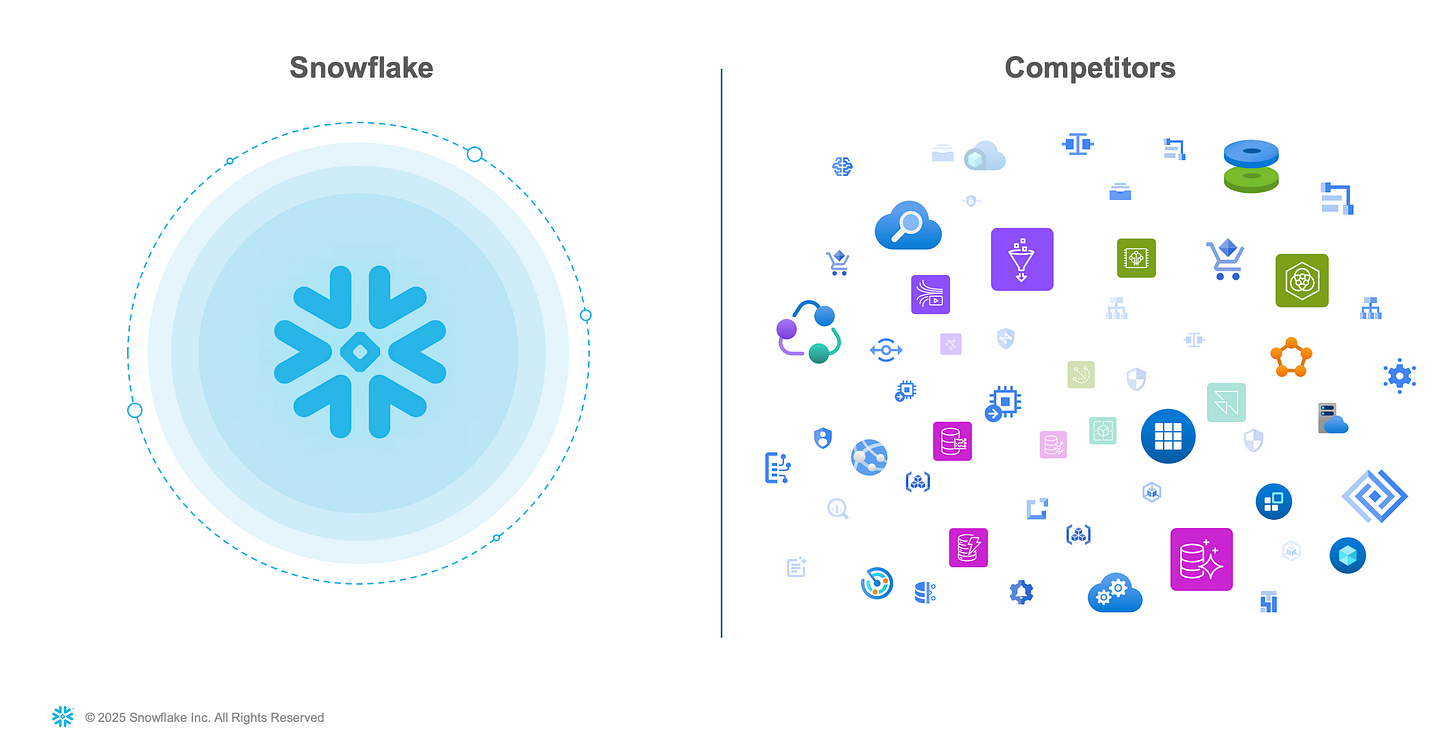

As the market transitioned toward cloud-first infrastructure, the landscape changed significantly, with primary competition emerging from Databricks and native hyperscaler offerings (Amazon Redshift, Google BigQuery, Microsoft Azure Synapse Analytics).

The 2023 explosion of LLMs led to two realizations. The first was that “big data” has always been a meme. Most companies never generated returns commensurate with what they could have achieved by productizing their datasets. The second was that productizing datasets is genuinely difficult and introduces significant complexity and knowledge thresholds required for successful execution. This fundamentally undermined Snowflake’s strategic positioning, as being “easy to deploy and visualize in analytics dashboards” mattered far less when companies were prioritizing AI adoption at scale. Databricks and the hyperscalers have been capturing the lion’s share of this opportunity.