Infra Play #116: Brick by brick

Databricks has emerged as one of the biggest AI success stories by doubling down on the same bet NVIDIA made a decade ago: that open source and AI would define the future.

Databricks is a company that has more similarities to Palantir than most other data players in the market today. This is somewhat ironic because much of what Databricks stands for is very much the opposite of how Palantir operates, both as a product and as an organization.

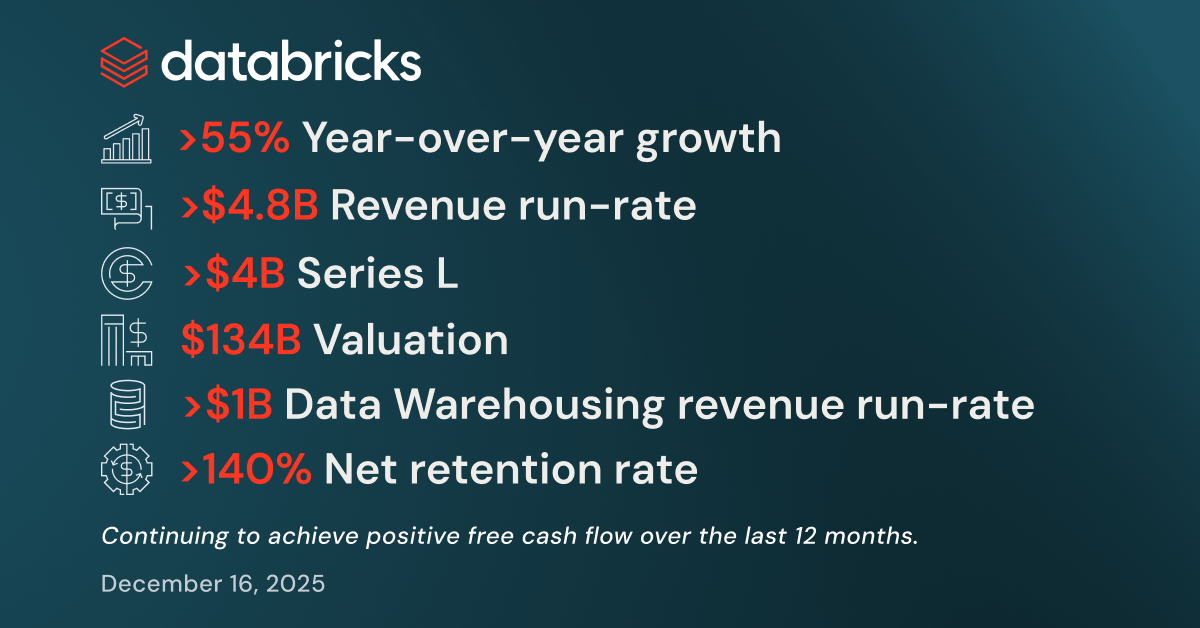

One of the key differences is performance. While Palantir recently reached $1B ARR run rate, Databricks announced in their Series K funding round in September:

Surpassing $4 billion in revenue run-rate, growing over 50% year over year.

Exceeding $1 billion in revenue run-rate for its AI products.

Achieving positive free cash flow over the last 12 months.

Maintaining a net retention rate exceeding 140%.

650+ customers each consuming over $1 million in annual revenue run-rate.

15,000 total customers.

With its current growth rate, Databricks will shortly become the largest modern pure-play data software vendor in the industry. Outside of legacy companies where data is part of their core product offering (such as Oracle and SAP) and the hyperscalers that store the vast majority of global datasets, no other data platform company has captured the last two years of AI-driven growth.

Unlike any other large player in the space, Databricks remains private. Databricks also open-sources the majority of its products. Having raised close to $21.8B in funding, the leadership appears uninterested in “cashing out” anytime soon.

Databricks is a company that wants to win it all.

Small status update on their business in late December’25…

The key takeaway

For tech sales and industry operators: Databricks is a company in its pre-monopoly phase. Interestingly enough, it’s reached this point by going against the typical factors that help you scale, i.e., high switching costs and customer captivity. Instead they focused on strong vertical integration and have spent the last 10 years rebuilding the data infrastructure stack from first principles. The strength of this thesis has been validated dramatically as AI workloads came into the scene, with the company essentially doubling over the last 2 years. Joining pre-monopoly is about equity upside and proprietary learning, not really OTE or having any semblance of a work-life balance. This is the place to learn how consumption pricing actually works at scale, how to sell technical complexity to enterprises making billion-dollar bets, and how platform strategies beat point solutions. There is an argument to be made that the easy gains have been captured and you should expect a rough ride if you join. Still, the question isn’t whether Databricks wins, but whether you’ll be there when they do.

For investors and founders: Databricks represents a classic case study in how technological paradigm shifts create opportunities for new infrastructure monopolies. They established the unified data and AI platform as a category that didn’t exist until they built it. The willingness to stay private and raise $15B shows they’re optimizing for winning the market, not cashing out. For investors, the key question is whether you’re buying near the peak of the AI hype cycle or early in a multi-decade transformation where Databricks becomes the default layer for enterprise data. The $100B valuation prices in continued dominance, but AWS, Google, and Azure have a lot of leverage as the data creation and storage often start in their estate. The bet is that Databricks’ decade of architectural optimization creates switching costs that contracts alone never could. For founders, study how they sequenced their expansion: start with genuine technical differentiation, resist premature monetization, build horizontal platform capabilities before competitors understand the game, then use open-source to establish the standard while keeping the best implementation proprietary. However this plays out, Databricks is what disciplined first-principles thinking, applied over a decade, can achieve.

The unified platform is not a meme

While the goal is to provide you with a deep dive here, I think that it’s useful to hear from Ali Ghodsi himself on how he sells the vision of the company. This is part of his keynote in their recent “Data+AI 2025” conference, where they introduce the Databricks vision from first principles and how recent product announcements, such as Lakebase, fit into that play.