Infra Play #114: MongoDB

MongoDB 3.0 is a major shift in every aspect of how the company operates, following ten years of essentially being a sales organization that happens to be selling tech, rather than a tech company

Source: 5 year performance of MongoDB stock on Perplexity Finance

MongoDB recently got some attention because “the stock was popping off” and “massive adoption for AI.” It’s one of the most well-known database companies in the industry, garnering attention and hate across a large spectrum of developers, sales reps, and investors.

It’s time to take a serious look at where MongoDB sits today and what the realistic path is for them to survive and scale over the next five years.

The key takeaway

For tech sales and industry operators: The problem when tech companies decide to win by being persuasive, rather than have the best product, is that things start to get ugly once there is a significant technology shift. Most of what MongoDB leadership claims to be key differentiators for the product are at best table stakes in order to get access to the decision maker table. The real moat for MongoDB has always been its GTM motion and enterprise relationships, but the sales team is going through complete restructuring and while 70% of the Fortune 500 might be customers, many of them have small workloads that can disappear in the next budgeting cycle. MongoDB 3.0 represents an attempt to turn the ship around and focus again on developer outcomes with superior technology. The reps who will succeed are those who realize MongoDB 3.0 is giving them permission to finally focus on customer outcomes over product shilling about “flexible documents”, and use every resource available to help customers actually ship.

For investors and founders: There is a significant difference between a good management team executing well and a business with structural advantages that compound over time. The reason why MongoDB barely has 2% of a market, regardless of massive brand recognition and one of the best sales teams in the industry, is because a real moat is switching costs, network effects, and cost advantages, things that the company clearly doesn’t have at the data layer. MongoDB 3.0 is a reactive transformation, rather than a proactive one, which brings significant execution risks as seen by the slow growth. The recent focus on driving more effective customer migrations and helping them build on top of MongoDB is the directionally correct one from a customer perspective, but likely will get penalized on the stock market because the current multiple makes no sense relative to the strength of the business. If the goal would be to chase Palantir style data transformation plays, then H2 FY26 is where things will become more clear in terms of execution. The asymmetric opportunity depends on Atlas revenue exceeding $170M per half. The early signals coming from the sales teams however are not positive.

MongoDB is AI scale

Source: MongoDB Investor Day 2025

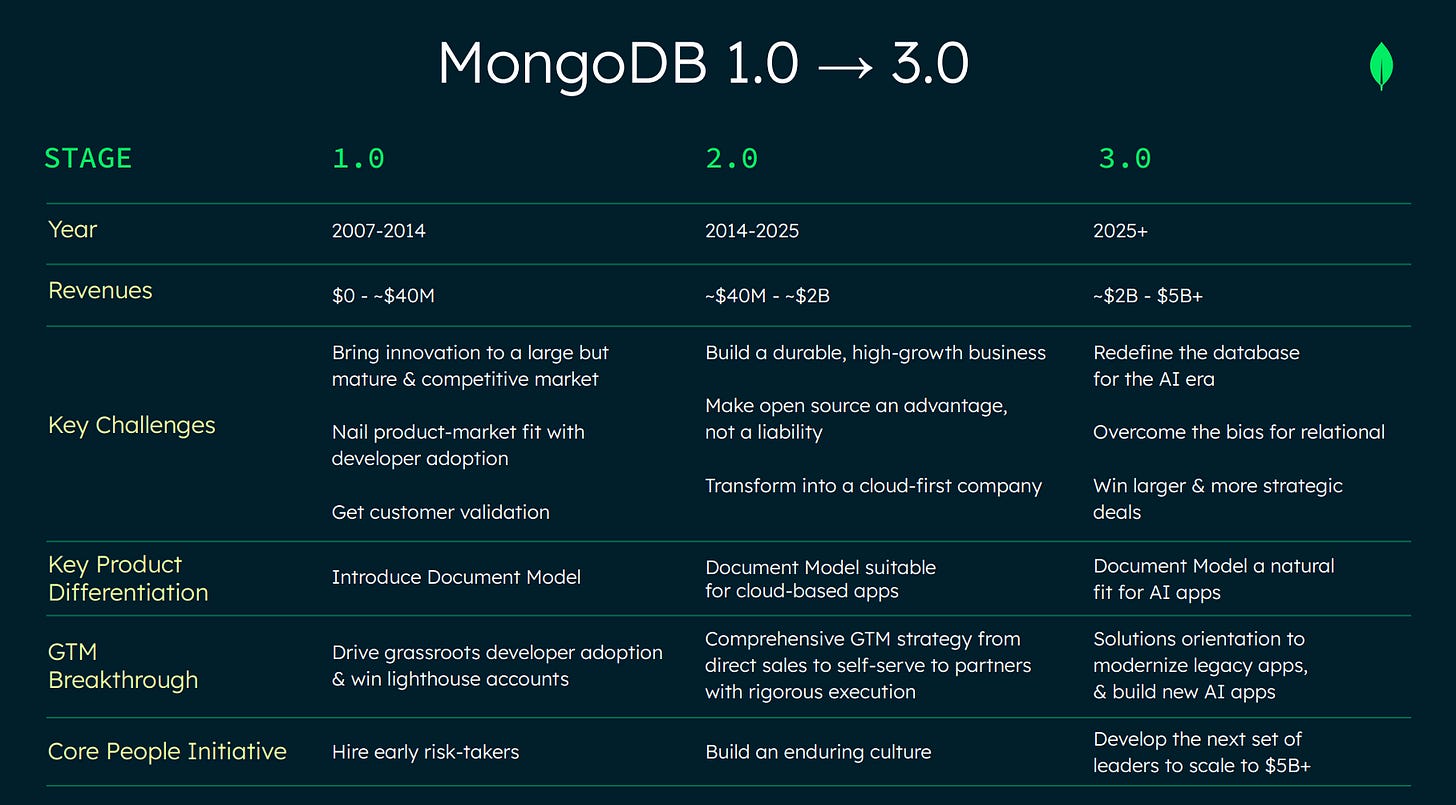

Dev Ittycheria: When I first joined MongoDB, we’re a fairly small company, still with a decent name, but still unproven and we had roughly 1,000 customers and we were doing a little under $40M that year. Just to put things in perspective, now we have nearly 60,000 customers and Wall Street estimates that we’ll do about $2.4B in revenue this year. To put that in perspective, we do now in one week more than we did when I joined eleven years ago. That gives you a sense of our growth. And the point is that our growth is as much about you as it’s about us.

As part of this deep dive, I’ll go over their recent Investor Day (September 2025) that outlined the vision and overall story of where they are going with the company. MongoDB’s culture is a strong reflection of the opinions of Dev, who is the guy that pulled the company out of its developer-focused workflow and into a 10-year journey of turning into an enterprise-first, sales-oriented organization.

He clearly sees the need to turn the company in a different direction, mostly positioned as an opportunity to “capture the opportunity.” There is an undercurrent that either he is not aware of or they are trying very hard to gloss over, which I will discuss in detail here.