Infra Play #110: The Larry Supremacy

The road to 1T market cap is paved with tech sales layoffs.

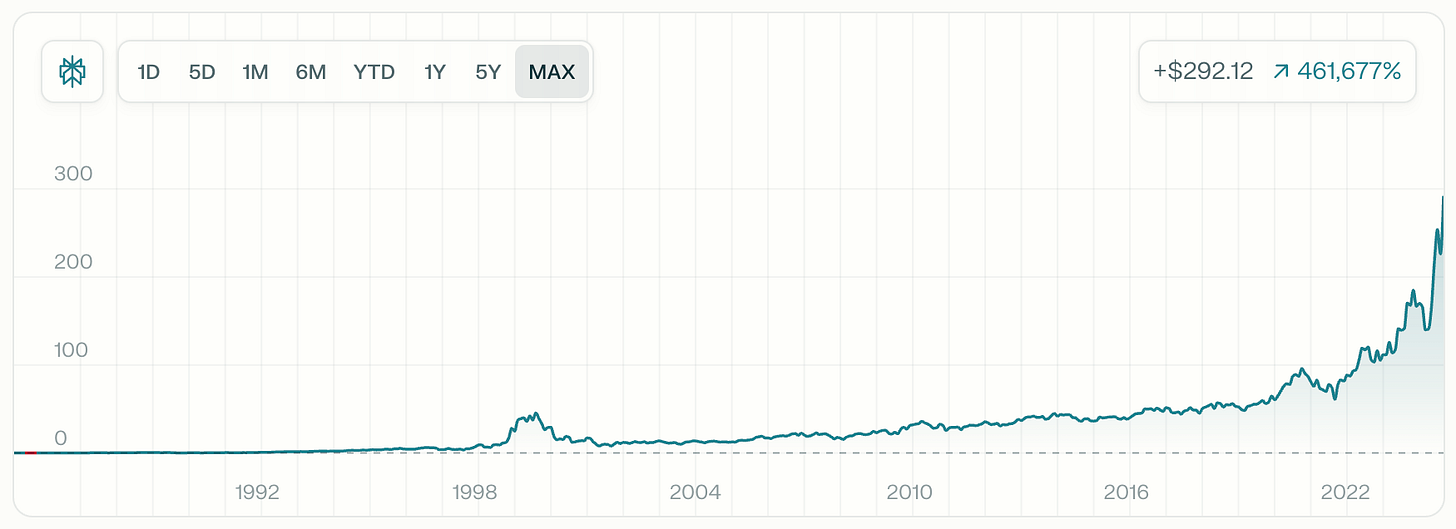

Source: Oracle on Perplexity Finance

As the timeline was getting overtaken by the massive price spike of Oracle stock this week, the obvious question seemed to grip everybody: Why is the market “suddenly” doing a price discovery based on a quarterly earnings report that, well, missed both earnings and profit estimates? And does this suddenly change the perception of the company from a tech sales perspective?

The key takeaway

For tech sales: If you needed any proof that the bottom of the stack is where the majority of the value from the first wave of AI will be captured, look no further than Oracle. 2025 saw the primary thesis around Oracle Cloud Infrastructure come to fruition, as the $300B OpenAI deal represents almost double the software revenue over the last 5 years. The problem with Oracle is that you, specifically, will never get to work on an account like this if you join them, but you can try and replicate some key plays in a different company. The infrastructure focus of OCI has elevated conversations that Oracle was previously involved in from IT to the C-Suite. The other key lesson is that customers are clearly willing to invest in AI + data + process outcomes, something that your company needs to offer in order to play in the big leagues.

For investors: For those that had an Oracle allocation, congrats. For the rest, it’s probably best to focus on something else with less backlog quality risk. The big deal behind the stock jump is mostly driven by the current AI training bottleneck. If capacity catches up with demand over the next few years, the pricing advantage that OCI has today will likely be gone and they’ll have to compete on product quality, which let’s be honest, they don’t have on the software side. The deal itself also has a significant conversion lag (contracted capacity → data-center readiness; readiness → customer acceptance, acceptance → steady-state consumption). So if your thesis relies on Oracle recognizing this revenue and you don’t have insider knowledge around the contractual terms, odds are that you’ll get caught holding the bag. The exception would be OCI splitting into a new company, but that’s a low probability event on a short time horizon.

Oracle Cloud Infrastructure is here to save the day

Safra Katz: Clearly, we had an amazing start to the year because Oracle has become the go-to place for AI workloads. We have signed significant cloud contracts with the who’s who of AI, including OpenAI, xAI, Meta, NVIDIA, AMD, and many others. At the end of Q1, remaining performance obligations or RPO now top $455 billion. This is up 359% from last year and up $317 billion from Q4. Our cloud RPO grew nearly 500% on top of 83% growth last year.

Now to the results. Using constant currency growth rates, as you can see, we’ve made some changes to the face of our income statement to better reflect how we manage the business and so you can understand our cloud business dynamics more directly. So here it goes. Total cloud revenue, that’s both apps and infrastructure, was up 27% to $7.2 billion. Cloud infrastructure revenue was $3.3 billion, up 54% on top of the 46% growth reported in Q1 last year. OCI consumption revenue was up 57% and demand continues to dramatically outstrip supply. Cloud database services, which were up 32%, now have annualized revenues of nearly $2.8 billion. Autonomous Database revenue was up 43% on top of the 26% growth reported in Q1 last year. Multi-cloud database revenue, where Oracle regions are embedded in AWS, Azure, and GCP, grew 1529% in Q1. Cloud application revenue was $3.8 billion, up 10%, while our strategic back-office application revenue was $2.4 billion, up 16%. Total software revenue for the quarter was $5.7 billion, down 2%.

So all in, total revenues for the quarter were $14.9 billion, up 11% from last year and higher than the 8% growth reported in 17% to $6.2 billion. We have also been on an accelerated journey to adopt AI internally to run more efficiently.

Basically everybody was shocked by the performance obligations jump i.e. they signed a $300B contract over five years with OpenAI to build out data centers and will get paid over time to deliver it.

Lawrence Ellison: Eventually, AI will change everything. But right now, AI is fundamentally transforming Oracle and the rest of the computer industry. Though not everyone fully grasped the magnitude of the tsunami that is approaching. Look at our quarterly numbers. Some things are undeniably evident. Several world-class AI companies have chosen Oracle to build large-scale GPU-centric data centers to train their AI models. That’s because Oracle builds gigawatt-scale data centers that are faster and more cost-efficient at training AI models than anyone else in the world. Training AI models is a gigantic multi-billion dollar market. It’s hard to conceive of a technology market as large as that one.

But if you look close, you can find one that’s even larger. It’s the market for AI inferencing. Millions of customers using those AI models to run businesses and governments. In fact, the AI inferencing market will be much, much larger than the AI training market. AI inferencing will be used to run robotic factories, robotic cars, robotic greenhouses, biomolecular simulations for drug design, interpreting medical diagnostic images and laboratory results, automating laboratories, placing bets in financial markets, automating legal processes, automating financial processes, automating sales processes. AI is going to write, that is, generate, the computer programs called AI agents that will automate your sales and marketing processes.

Let me repeat that. AI is going to automatically write the computer programs that will then automate your sales processes and your legal processes and everything else and your factories and so on. Think about it. AI inferencing. It’s AI inferencing that will change everything. Oracle is aggressively pursuing the AI market. And we’re not doing badly in the AI training market, by the way. The difference seems bigger. Oracle is aggressively pursuing the inferencing market as well as the AI training market. We think we are in a pretty good position to be a winner in the inferencing market because Oracle is by far the world’s largest custodian of high-value private enterprise data.

With the introduction of our new AI database, we added a very important new way for you to store your data in our database. You can vectorize it. And by vectorizing it, by vectorizing all your data, all your data can be understood by AI models. Then we made it very easy for our customers to directly connect all their databases, all their new Oracle AI databases, and cloud storage OCI cloud storage, to the world’s most advanced AI reasoning models. ChatGPT, Gemini, Grok, Lama, all of which are uniquely available in the Oracle Cloud. After you vectorize your data and link it to an LLM, the LLM of your choice, you can then ask any question you can think of. For example, how will the latest tariffs impact next quarter’s revenue and profit? You ask that question. The large language model will then apply advanced reasoning to the combination of your private enterprise data plus publicly available data. You get answers to important questions without ever compromising the safety and security of your private data.

Again, I’d like you to think about this for a moment. A lot of companies are saying we’re big into AI because we’re writing agents. Well, guess what? We’re writing a bunch of agents too. But when they introduced ChatGPT almost three years ago, what you’ve got to do is have a conversation and ask questions. You weren’t automating some process with an agent. You could ask whatever question you wanted to ask and get a well-reasoned answer with all of the latest and best information and high-quality reasoning to go along with it. Who’s offering that to customers? We’ll be the first. When we deliberate and demonstrate it at AI World next month.

That’s what our customers have been asking for ever since the introduction of ChatGPT 3.5, almost three years ago. I wanted to ask questions about anything. And, therefore, you need to understand my enterprise data as well as all the publicly available data. Then you can answer the questions that are most important to me. Well, now they can ask those questions.

Now, technically Larry is not saying anything new here that readers of this newsletter are not familiar with. Still, an 81-year-old corpo dinosaur is betting the full company on delivering massive amounts of training and inference capacity. That’s either the biggest top signal of all time or should show how obvious the future looks to even folks who are unlikely to see out the full transformation of computing.

Derrick Wood: I’ll echo my congratulations on this momentous quarter. Safra, the fact that you delivered over $300 billion of new RPO in Q1, just really amazing to see it’s going to require a lot of infrastructure build-out. So could you provide a bit more context on how much CapEx and operational cost structure will be needed to fully service these contracts, how we should think about the ramp of these costs relative to the ramp in revenue over the next few years, and generally, how investors should be thinking about the ROI on the spend?

Safra Catz So first of all, as I mentioned in the prepared remarks and as I’ve said very clearly beforehand, we do not own the property. We do not own the buildings. What we do own and what we engineer is the equipment, and that’s equipment that is optimized for the Oracle Cloud. It has extremely special networking capabilities. It has technical capabilities from Larry and his team that allows us to run these workloads much, much faster. And as a result, it’s much cheaper than our competitors. And depending on the workload.

Now because of that, what we do is we put in that equipment only when it’s time, and, usually, very quickly assuming that our customer accepts it, we’re already generating revenue. Right away. The faster they accept the system and that it meets their needs, the faster they start using it. The sooner we have revenue. This is, in some ways, I don’t want to call it asset light, from the finance world, but it’s assets pretty light. And that is really an advantage for us. I know some of our competitors, they like to own buildings. That’s not really our specialty. Our specialty is the unique technology, the unique networking, the storage, the just the whole way we put these systems together. And by the way, they are identical, and very simplified and, again, making it possible for us to be very profitable while still being able to offer our customers an incredibly compelling price.

What I have indicated is that CapEx looks like it’s going to be about $35 billion for this fiscal year. But because we’re monitoring this, we’re literally putting it in right when we take possession, and then handing it over to generate revenue right away. So we have a very good line of sight for our capabilities to put this out and to just spend on that CapEx right before it starts generating revenue. But at this point, I’m looking at $35 billion for the year. And I think, I mean, it could be a little higher, but I think and if it is higher, it’s good news.

Because it means more capacity has been handed to me in terms of floor space. And as you also know, we are embedded in our competitors’ clouds, again, all we are responsible for to pay for is in fact our equipment, and that goes right away. And there, we’re moving ultimately to 71 data centers embedded in our competitors or flash partners.

This is probably the most interesting point out of this - the reason why Oracle is winning those contracts is because it’s able to provide a working server infrastructure at barebones pricing vs. the other hyperscalers. This is quite important to OpenAI because unlike Musk and xAI, they lack both the desire and capability to quickly execute new data center buildouts by themselves. While they can always raise more money and try to do it, a more obvious play is to let Oracle deliver the project. It also helps that this is done between US companies, rather than having to go and try their luck with the legal, political and technical drama of trying to do it with Alibaba.